Trending...

- Blake Harris the Leading Authority in International Asset Protection Joins Tom Hegna on "Financial Freedom with Tom Hegna"

- Pyro Marketing Launches New Website to Accelerate Growth for Fitness Brands

- Santa Monica Businesses Push Back on Bus Stop Relocation That Threatens Access and Safety

IQSTEL, Inc. (Stock Symbol: IQSTD) On Track Towards $1 Billion in Revenue by 2027.

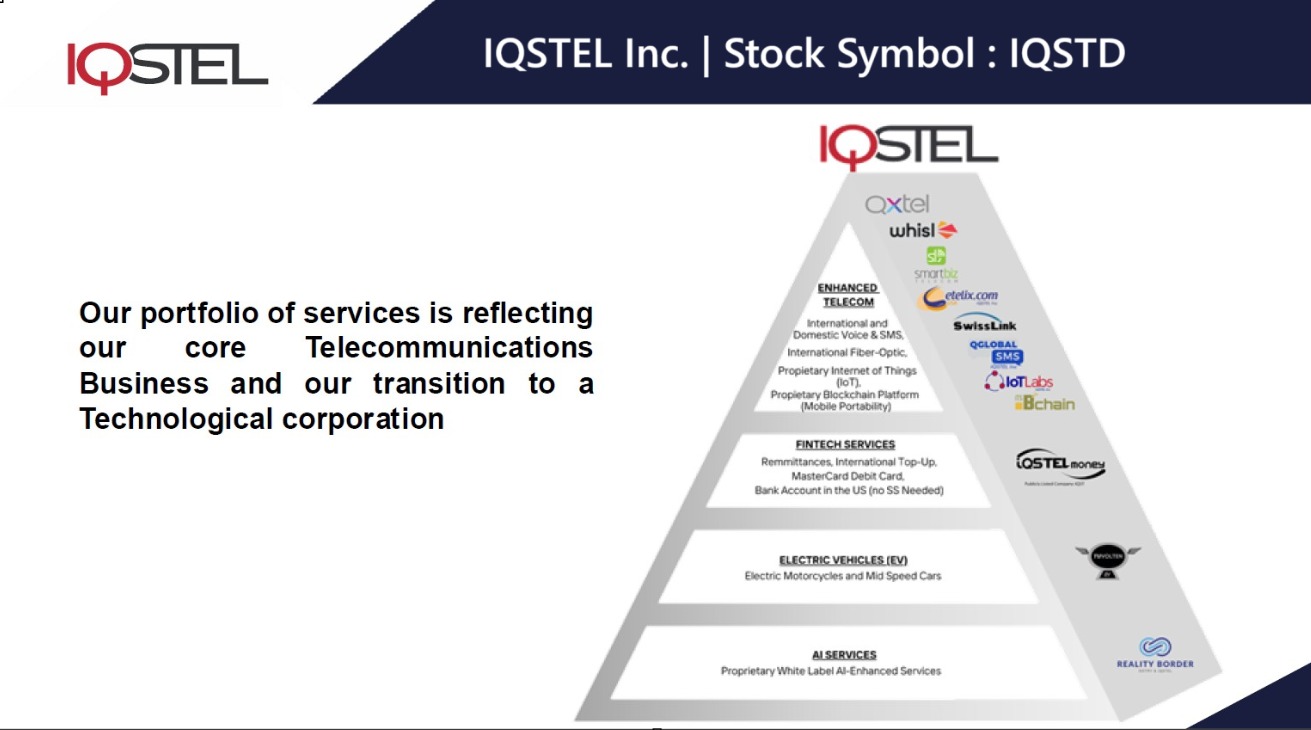

CORAL GABLES, Fla. - PrAtlas -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

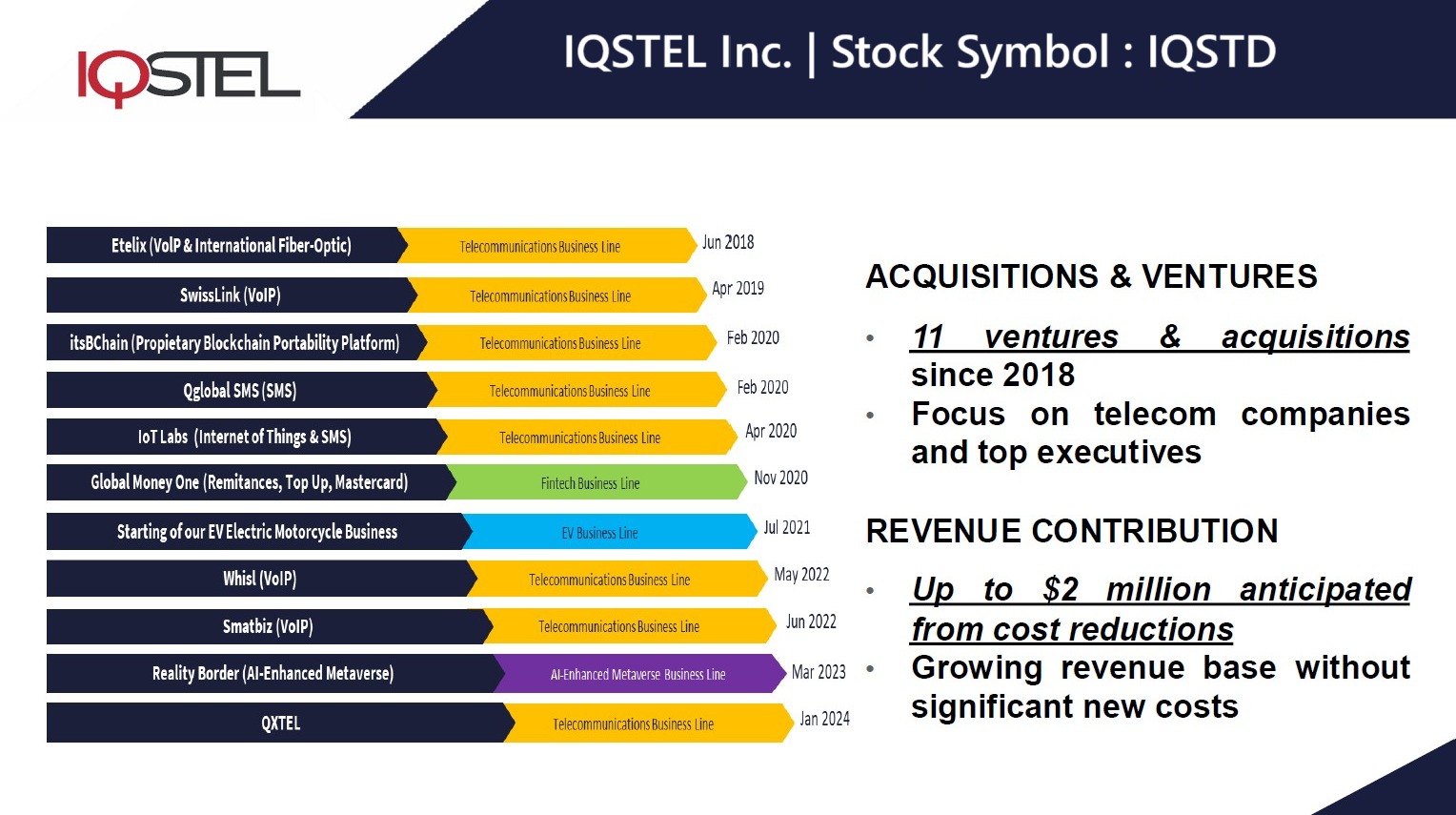

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company's commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

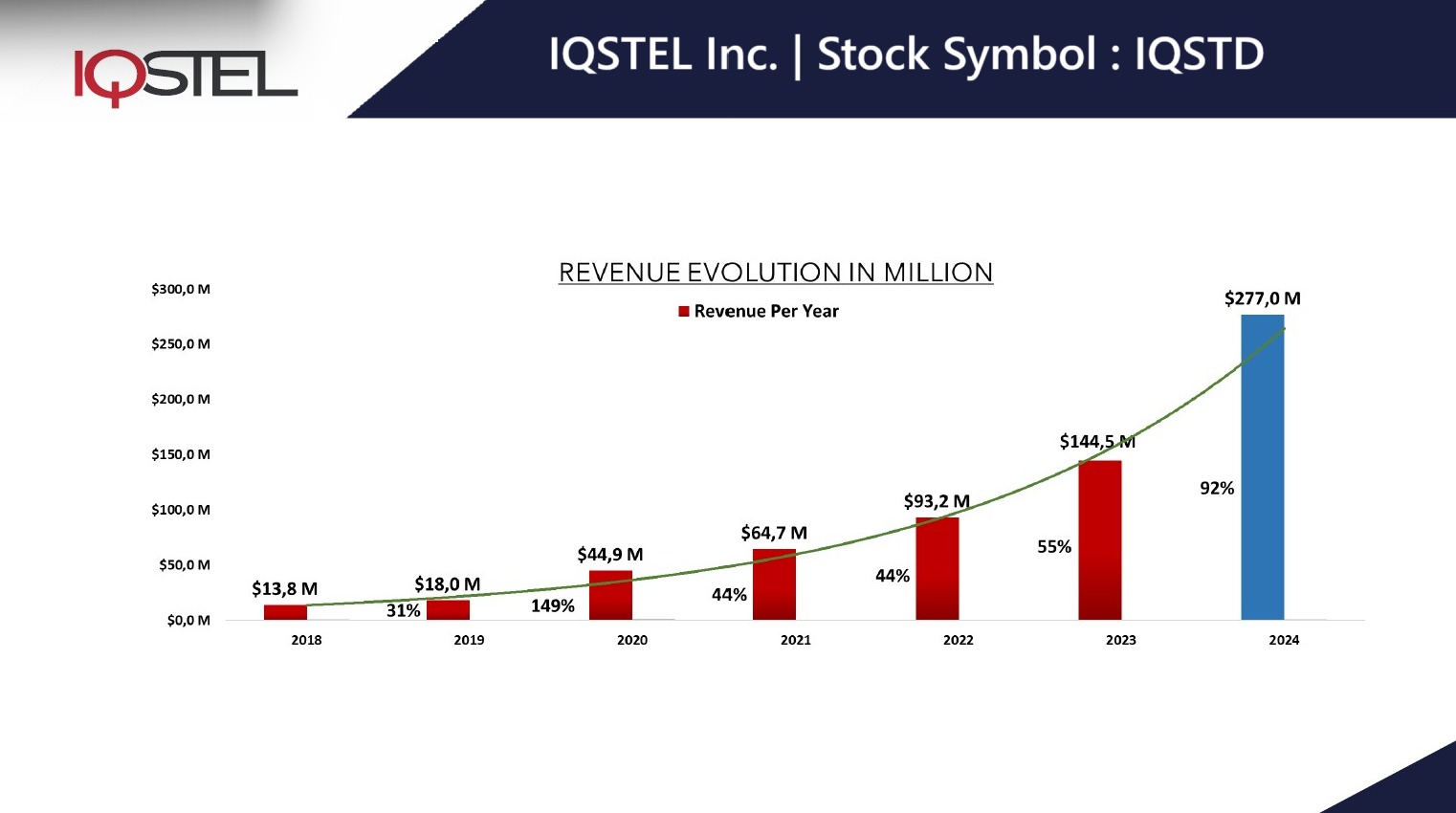

More on PrAtlas

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company's strong momentum heading into 2025. Historically, IQSTEL's second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

More on PrAtlas

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company's commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

More on PrAtlas

- SeedList Launching Institutional Crypto Crowdfunding Project to Empower Retail Investors and Disrupt the VC-Dominated Crypto Fundraising Landscape

- California Family Launches Billboard to Reach "Pardon Czar" Alice Marie Johnson

- Rent Like A Champion Acquires CollegeWeekends

- Sumter Landing Dental Care Launches Summer Special on Full Mouth Reconstruction

- Seligson Law Launches New Website to Support Cannabis Businesses in California and New York

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company's strong momentum heading into 2025. Historically, IQSTEL's second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

More on PrAtlas

- databahn Announces Subscription Access to Fortune 500 GenAI Deep Dive Sales Intelligence Reports

- AI startup Congero offers instant websites with 24/7 updates - aiming to replace web agencies

- WonderDays Launches the UK's First AI Experience Gift Finder – Gifting Just Got So Much Easier!

- CelluHeal™ Launches Full Line of Advanced Wound Dressings for Online Purchase in the USA, Canada, and Beyond

- Nonprofit innovator named Mensa Executive Director

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business, Technology, Telecom, Stocks, Financial, Finance, Artificial Intelligence, Stock Market, Press Release, Nasdaq, Cybersecurity, Fintech

0 Comments

Latest on PrAtlas

- ICAST 2025: The Crystal-Clear Revolution Begins at Booth #3233

- Brindle Pet Supplies Now Carries Badlands Ranch Dog Food in Canada

- $10 Million Allocated to Establish Crypto Treasury Focused on High Value Ethereum (ETH) & Bitcoin (BTC) as Long-Term Holdings for Cybersecurity Leader

- Sing For Your Supper: A Night of Musical Comedy and Drag for a Great Cause

- Cummings Graduate Institute for Behavioral Health Studies Celebrates New DBH Graduates

- $100 to $200 Million Equity Agreement with Top Digital Advisor Bitwise to Power Major Digital Asset Initiative for Bitcoin and Solana: OFA Group

- New Collaboration Launches Corporate ESG Solution for Responsible Decommissioning and Transparent Reporting

- SlickCashLoan Launches Free Loan Calculator to Help You Plan Monthly Payments

- TikTok Star ArcadeFriends Attempts 24-Hour Claw Machine Marathon at Lucky Puppy Arcade in Las Vegas

- Pyro Marketing Launches New Website to Accelerate Growth for Fitness Brands

- KCON LA 2025, 106.3 RAIN FM 'Take Over' Special Event

- The Citizens Commission on Human Rights Annual Purple Heart Day Event will be Hosted at the Historic Fort Harrison

- Blake Harris the Leading Authority in International Asset Protection Joins Tom Hegna on "Financial Freedom with Tom Hegna"

- Psychedelics for Vets? CCHR Cites History of Exploitation and Failed Science

- GreenPal Empowers Lawn Care Pros Leveraging AI, Surpasses 5 Million Transactions

- Santa Monica Businesses Push Back on Bus Stop Relocation That Threatens Access and Safety

- The Blue Luna Encourages Local Schools to Take Steps to Enhance Safety for Students and Staff

- The Sessions Studios Secures $300 Million Commitment to Launch World-Class Studio and 15-Film Global Slate

- Smart Resnse Unveils Smart Resnse(SRMS) Token-Powered AI Orchestration Platform to Revolutionize Multi-Billion Dollar Market

- Josh and Heidi Follow Up the Much Anticipated and Successful Launch of the "Spreading the Good BUZZ" Podcast with a Personal Request