Trending...

- Kaltra Introduces New Downward-Spraying Distribution Technology to Boost Microchannel Evaporator Performance

- NaturismRE Launches the NRE Health Institute to Advance Evidence-Informed Public Health Research

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

Innovation Beverage Group (Nas daq: IBG) $IBG is On-Track to Complete its Proposed Merger with BlockFuel in the First Quarter of 2026

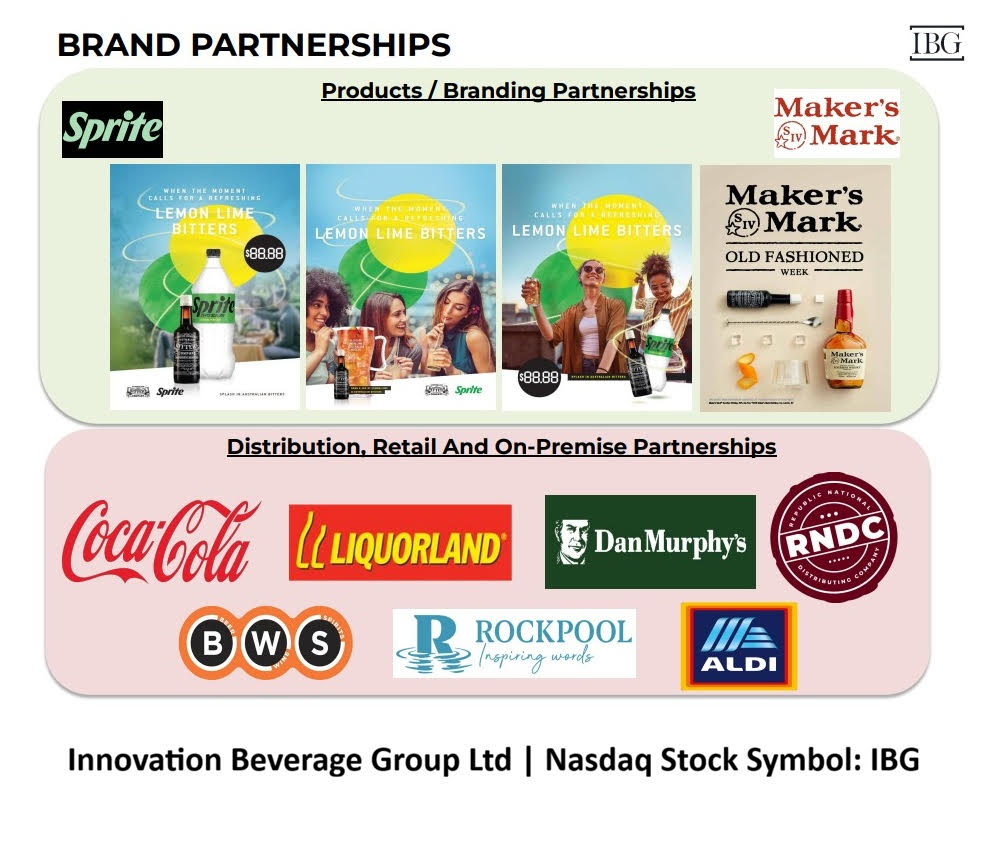

SEVEN HILLS, Australia - PrAtlas -- Manufacturer, Marketer, Exporter, and Retailer for Beverage Portfolio of 60 Formulations Across 13 Popular Alcoholic and Non-Alcoholic Brands.

Company is Owner of Exclusive Manufacturing Rights.

Brands Include Australian Bitters, BITTERTALES, Drummerboy Spirits, Twisted Shaker, and More.

Manufacturing and Flavor Innovation Center Located in Sydney, Australia with a U.S. Sales Office Located in California.

Small Share Structure with Only 672,664 Shares Outstanding.

Planned Merger with BlockFuel Energy and Production Restart to Advance Dual Revenue Model Spanning Energy and Digital Asset Mining.

On Track to Complete BlockFuel Energy Merger in the First Quarter of 2026.

Onsite Natural Gas–Powered Digital Mining Strategy Positions Combined Group for Capital-Efficient, Scalable Cash Flow Generation.

Innovation Beverage Group (Nas daq: IBG) $IBG is a developer, manufacturer, marketer, exporter, and retailer of a growing beverage portfolio of 60 formulations across 13 alcoholic and non-alcoholic brands for which it owns exclusive manufacturing rights. Focused on premium and super premium brands and market categories where it can disrupt age old brands, IBG brands include Australian Bitters, BITTERTALES, Drummerboy Spirits, Twisted Shaker, and more.

The most successful IBG brand to date is Australian Bitters, which is a well-established and favored bitters brand in Australia. Established in 2018, the IBG headquarters, manufacturing and flavor innovation center are located in Sydney, Australia with a U.S. sales office located in California.

After completing a five-for-one (5-for-1) reverse split on January 30th, IBG now offers investors a very attractive share structure with only 672,664 shares outstanding.

More on PrAtlas

IBG has announced that management intends to hold an annual meeting of shareholders by March 31, 2026 to remain in compliance with Nasdaq listing requirements.

Update on Merger with BlockFuel Energy and Production Restart to Advance Dual Revenue Model Spanning Energy and Digital Asset Mining

On February 11th IBG provided an update regarding a proposed merger with BlockFuel Energy Inc., a Texas corporation ("BFE"), including operational, financial, and strategic milestones that position the combined transaction parties as a capital-efficient energy producer with a differentiated digital infrastructure growth strategy.

IBG remains on track to complete the merger in the first quarter of 2026. Integration planning continues, with a clear focus on building a vertically integrated platform that monetizes hydrocarbons through both conventional sales channels and potential digital energy applications.

BlockFuel Energy is involved in the acquisition, exploration and development of proven oil fields onshore in North America. By turning natural gas at the source, including stranded and flared gas, into a potent resource for the digital era, BlockFuel Energy intends to redefine the energy industry. BlockFuel Energy combines state-of-the-art power generation with oil and gas exploration to power bitcoin mining operations and high-performance data centers. Our vertically integrated concept allows us to use co-location and modular power generation techniques to optimize efficiency and investment returns. Our cutting-edge solutions for energy optimization and extraction will enable us to transform underdeveloped resources into high-margin, scalable, and sustainable revenue streams. For more information visit: https://blockfuelenergy.com/.

More on PrAtlas

BFE expects to complete its first oil and gas sales in February 2026, with initial revenues anticipated before the end of the first quarter ended March 31, 2026. These initial oil and gas revenues are expected to provide near-term cash-flow visibility following completion of the IBG merger.

In parallel with production restarts, planning is advancing for the potential deployment of digital mining infrastructure powered directly by natural gas produced onsite. Initial planning takes into consideration modular, wellhead-adjacent generation and mining deployments, allowing capacity to scale in-line with gas availability and capital deployment.

Further strengthening the IBG asset base, BFE has executed a Letter of Intent with a previous vendor to acquire additional nearby producing oil fields, adding approximately 4,000 contiguous acres to its portfolio. The proposed acquisition is expected to both expand scale and improve operating efficiencies, increasing gas volumes available for both traditional sales and digital energy initiatives.

Upon completion, the combined group is expected to emerge as a small-cap, integrated energy company with near-term production, diversified revenue streams, and a scalable gas-to-digital infrastructure platform positioned to deliver long-term shareholder value.

For more information on IBG visit: : https://www.innovationbev.com/

Media Contact:

Company Name: Innovation Beverage Group Ltd (Nas daq:IBG)

Contact: Investor Relations

Email: investorrelations@innovationbev.com

Phone: +61 (02) 9620 4574

Country: Australia

Website: https://blockfuelenergy.com/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Company is Owner of Exclusive Manufacturing Rights.

Brands Include Australian Bitters, BITTERTALES, Drummerboy Spirits, Twisted Shaker, and More.

Manufacturing and Flavor Innovation Center Located in Sydney, Australia with a U.S. Sales Office Located in California.

Small Share Structure with Only 672,664 Shares Outstanding.

Planned Merger with BlockFuel Energy and Production Restart to Advance Dual Revenue Model Spanning Energy and Digital Asset Mining.

On Track to Complete BlockFuel Energy Merger in the First Quarter of 2026.

Onsite Natural Gas–Powered Digital Mining Strategy Positions Combined Group for Capital-Efficient, Scalable Cash Flow Generation.

Innovation Beverage Group (Nas daq: IBG) $IBG is a developer, manufacturer, marketer, exporter, and retailer of a growing beverage portfolio of 60 formulations across 13 alcoholic and non-alcoholic brands for which it owns exclusive manufacturing rights. Focused on premium and super premium brands and market categories where it can disrupt age old brands, IBG brands include Australian Bitters, BITTERTALES, Drummerboy Spirits, Twisted Shaker, and more.

The most successful IBG brand to date is Australian Bitters, which is a well-established and favored bitters brand in Australia. Established in 2018, the IBG headquarters, manufacturing and flavor innovation center are located in Sydney, Australia with a U.S. sales office located in California.

After completing a five-for-one (5-for-1) reverse split on January 30th, IBG now offers investors a very attractive share structure with only 672,664 shares outstanding.

More on PrAtlas

- Serina Damesworth Hired as Century Fasteners Corp. – Director of Quality

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- Distributed Social Media - Own Your Content

- Tarrytown Expocare Pharmacy Announces Strategic Leadership Appointments to Accelerate Growth and Innovation

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

IBG has announced that management intends to hold an annual meeting of shareholders by March 31, 2026 to remain in compliance with Nasdaq listing requirements.

Update on Merger with BlockFuel Energy and Production Restart to Advance Dual Revenue Model Spanning Energy and Digital Asset Mining

On February 11th IBG provided an update regarding a proposed merger with BlockFuel Energy Inc., a Texas corporation ("BFE"), including operational, financial, and strategic milestones that position the combined transaction parties as a capital-efficient energy producer with a differentiated digital infrastructure growth strategy.

IBG remains on track to complete the merger in the first quarter of 2026. Integration planning continues, with a clear focus on building a vertically integrated platform that monetizes hydrocarbons through both conventional sales channels and potential digital energy applications.

BlockFuel Energy is involved in the acquisition, exploration and development of proven oil fields onshore in North America. By turning natural gas at the source, including stranded and flared gas, into a potent resource for the digital era, BlockFuel Energy intends to redefine the energy industry. BlockFuel Energy combines state-of-the-art power generation with oil and gas exploration to power bitcoin mining operations and high-performance data centers. Our vertically integrated concept allows us to use co-location and modular power generation techniques to optimize efficiency and investment returns. Our cutting-edge solutions for energy optimization and extraction will enable us to transform underdeveloped resources into high-margin, scalable, and sustainable revenue streams. For more information visit: https://blockfuelenergy.com/.

More on PrAtlas

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

- March Is Skiing's Smartest Buying Window

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

- Tobu Group's "T-home Series" of Accommodations in Tokyo Just Opened "T-home KEI."

- Custom Wooden Token Manufacturer Celebrates 10 Years of Helping Brands Stay Top of Mind

BFE expects to complete its first oil and gas sales in February 2026, with initial revenues anticipated before the end of the first quarter ended March 31, 2026. These initial oil and gas revenues are expected to provide near-term cash-flow visibility following completion of the IBG merger.

In parallel with production restarts, planning is advancing for the potential deployment of digital mining infrastructure powered directly by natural gas produced onsite. Initial planning takes into consideration modular, wellhead-adjacent generation and mining deployments, allowing capacity to scale in-line with gas availability and capital deployment.

Further strengthening the IBG asset base, BFE has executed a Letter of Intent with a previous vendor to acquire additional nearby producing oil fields, adding approximately 4,000 contiguous acres to its portfolio. The proposed acquisition is expected to both expand scale and improve operating efficiencies, increasing gas volumes available for both traditional sales and digital energy initiatives.

Upon completion, the combined group is expected to emerge as a small-cap, integrated energy company with near-term production, diversified revenue streams, and a scalable gas-to-digital infrastructure platform positioned to deliver long-term shareholder value.

For more information on IBG visit: : https://www.innovationbev.com/

Media Contact:

Company Name: Innovation Beverage Group Ltd (Nas daq:IBG)

Contact: Investor Relations

Email: investorrelations@innovationbev.com

Phone: +61 (02) 9620 4574

Country: Australia

Website: https://blockfuelenergy.com/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on PrAtlas

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- Vesica Health Receives FDA Breakthrough Device Designation for AssureMDx

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- Cancun All Inclusive is ready for Spring Break 2026 with new Resorts, Exclusive Deals, activities and more!

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

- Best Book Publishing Company for Aspiring Authors

- Dr. Nadene Rose Releases Moving Memoir on Faith, Grief, and Divine Presence

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

- ASTI Ignites the Space Economy: Powering SpaceX's NOVI AI Pathfinder with Breakthrough Solar Technology: Ascent Solar Technologies (N A S D A Q: ASTI)

- Hiring has reached a "Digital Stalemate"—Now, an ex-Google recruiter is giving candidates the answers

- 2026 Pre-Season Testing Confirms a Two-Tier Grid as Energy Management Defines Formula 1's New Era

- Platinum Car Audio LLC Focuses on Customer-Driven Vehicle Audio and Electronics Solutions

- Postmortem Pathology Expands Independent Autopsy Services in Kansas City

- Postmortem Pathology Expands Independent Autopsy Services Across Colorado

- $38 Million in U.S. Government Contract Awards Secured Through Strategic Partner. Establishing Multi-Year Defense Revenue Platform Through 2032: $BLIS

- Mecpow M1: A Safe & Affordable Laser Engraver Built for Home DIY Beginners

- CrashStory.com Launches First Colorado Crash Data Platform Built for Victims, Not Lawyers

- Inkdnylon Earns BBB Accreditation for Verified Business Integrity

- Josh Stout "The Western Project"