Trending...

- Cold. Clean. Anywhere. Meet FrostSkin

- PRÝNCESS Builds Anticipation With "My Nerves" — A Girls-Girl Anthem

- Conexwest Delivers Custom Shipping Container MRI Lab, Saving California Hospital an Estimated $9 Million in Renovation Costs

Off The Hook YS Inc. (NYSE American: OTH) $OTH is Projected to Reach $140 to $145 Million in 2026 and is Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry

WASHINGTON, N.C. - PrAtlas -- Off The Hook YS Inc. (NYSE American: OTH) is quietly transforming the fragmented pre-owned boat market into a data-driven, institutional-grade platform—and investors are beginning to take notice.

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

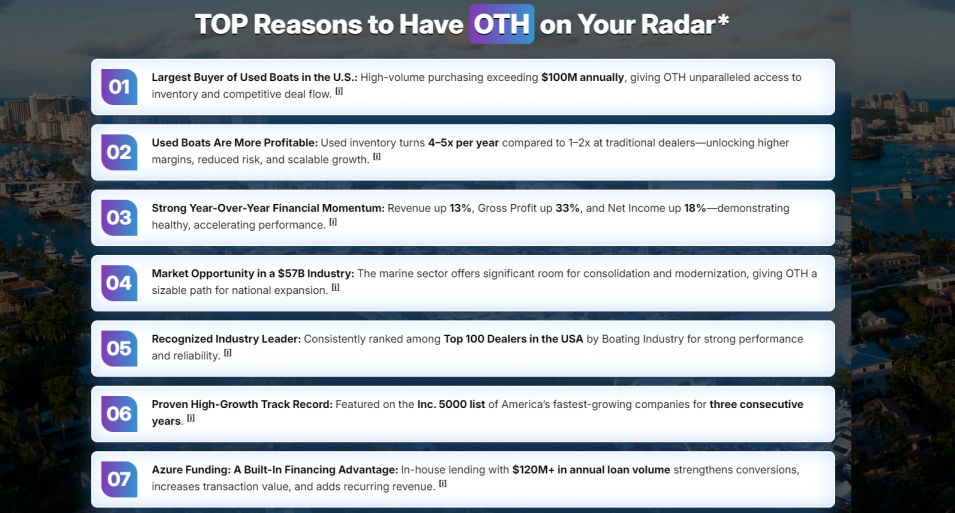

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on PrAtlas

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

Nine-Month 2025 Highlights

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on PrAtlas

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on PrAtlas

- UK Financial Ltd Sets February 27 CATEX Debut for VENUS Coin, Opening Limited Early Access Through MayaPro Wallet

- Ice Melts. Clean Water Fails. A Startup Thinks It Has the Fix

- Delay In Federal Disaster Assistance Causing Failure Of Small Business In Disaster Areas

- Capsadyn® Launches on Amazon, Offering Non-Burning Capsaicin Pain Relief

- When Representation No Longer Reflects the District — Why I'm Voting for Pete Verbica

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

- Revenue of $24.0 million

- 112 boats sold, up 51% year over year

- Second-highest quarterly unit volume in company history

- Gross profit of $3.0 million

- Adjusted EBITDA of $0.5 million

- Net loss narrowed to $0.07 million

- Launch of Autograph Yacht Group, a luxury brokerage division

- Addition of 10 new brokers

Nine-Month 2025 Highlights

- Record revenue of $82.6 million, up 19.3%

- 310 boats sold, up 24.4%

- Net income of $0.8 million

- Gross profit of $8.4 million, up $1.5 million year over year

- Adjusted EBITDA of $2.6 million

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on PrAtlas

- Off The Hook YS (NY SE: OTH) Executes Transformational Apex Acquisition, Creating Vertically Integrated Marine Powerhouse with $60M Inventory Capacity

- Tri-State Area Entrepreneur Launches K-Chris: A Premium Digital Destination for Luxury Fragrances

- Why One American Manufacturer Builds BBQ Smokers to Aerospace Standards

- Diversified Roofing Solutions Strengthens Industry Leadership With Expanded Roofing Services Across South Florida

- ZRCalc™ Cinema Card Calculator Now Available for Nikon ZR Shooters

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

- Record revenues

- Rapid unit growth

- A national footprint

- AI-enabled operations

- A rare tax incentive tailwind

- And participation in a multi-decade growth industry

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

- BD Deep Investor Research Report (Dec. 8, 2025):

Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry

👉 https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf - Company Website: www.offthehookyachts.com

- Investor Media: https://compasslivemedia.com/oth/

- Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on PrAtlas

- Cold. Clean. Anywhere. Meet FrostSkin

- How Specialized Game Development Services Are Powering the Next Wave of Interactive Entertainment

- Don't Settle for a Lawyer Who Just Speaks Spanish. Demand One Who Understands Your Story

- Dan Williams Promoted to Century Fasteners Corp. – General Manager, Operations

- Ski Johnson Inks Strategic Deals with Three Major Food Chain Brands

- NIL Club Advances Agent-Free NIL Model as Oversight Intensifies Across College Athletics

- Atlanta Magazine Names Dr. Rashad Richey One of Atlanta's Most Influential Leaders in 2026 as the FIFA World Cup Approaches

- Apostle Margelee Hylton Announces the Release of Third Day Prayer

- Slotozilla Reports Strong Q4 Growth and Sigma Rome Success

- "Lights Off" and Laughs On: Joseph Neibich Twists Horror Tropes in Hilariously Demonic Fashion

- Families Gain Clarity: Postmortem Pathology Expands Private Autopsy Services in St. Louis

- Beethoven: Music of Revolution and Triumph - Eroica

- Amy Turner Receives 2025 ENPY Partnership Builder Award from The Community Foundation

- Hubble Tension Solved? Study finds evidence of an 'Invisible Bias' in How We Measure the Universe

- Boonuspart.ee Acquires Kasiino-boonus.ee to Strengthen Its Position in the Estonian iGaming Market

- Vines of Napa Launches Partnership Program to Bolster Local Tourism and Economic Growth

- Finland's €1.3 Billion Digital Gambling Market Faces Regulatory Tug-of-War as Player Protection Debate Intensifies

- Angels Of Dirt Premieres on Youtube, Announces Paige Keck Helmet Sponsorship for 2026 Season

- Still Using Ice? FrostSkin Reinvents Hydration

- Patron Saints Of Music Names Allie Moskovits Head Of Sync & Business Development