Trending...

- T-TECH Partners with Japan USA Precision Tools for 2026 US Market Development of the New T-TECH 5-Axis QUICK MILL™

- UK Financial Ltd Announces A Special Board Meeting Today At 4PM: Orders MCAT Lock on CATEX, Adopts ERC-3643 Standard, & Cancels $0.20 MCOIN for $1

- New YouTube Channel Pair Launches to Bring Entertainment Nostalgia Back to Life

Tradewinds Universal, Inc. (Symbol: TRWD) $TRWD Strategic Roadmap Includes Uplisting to NASDAQ or NYSE Emphasizing Tangible, Revenue-Generating Assets

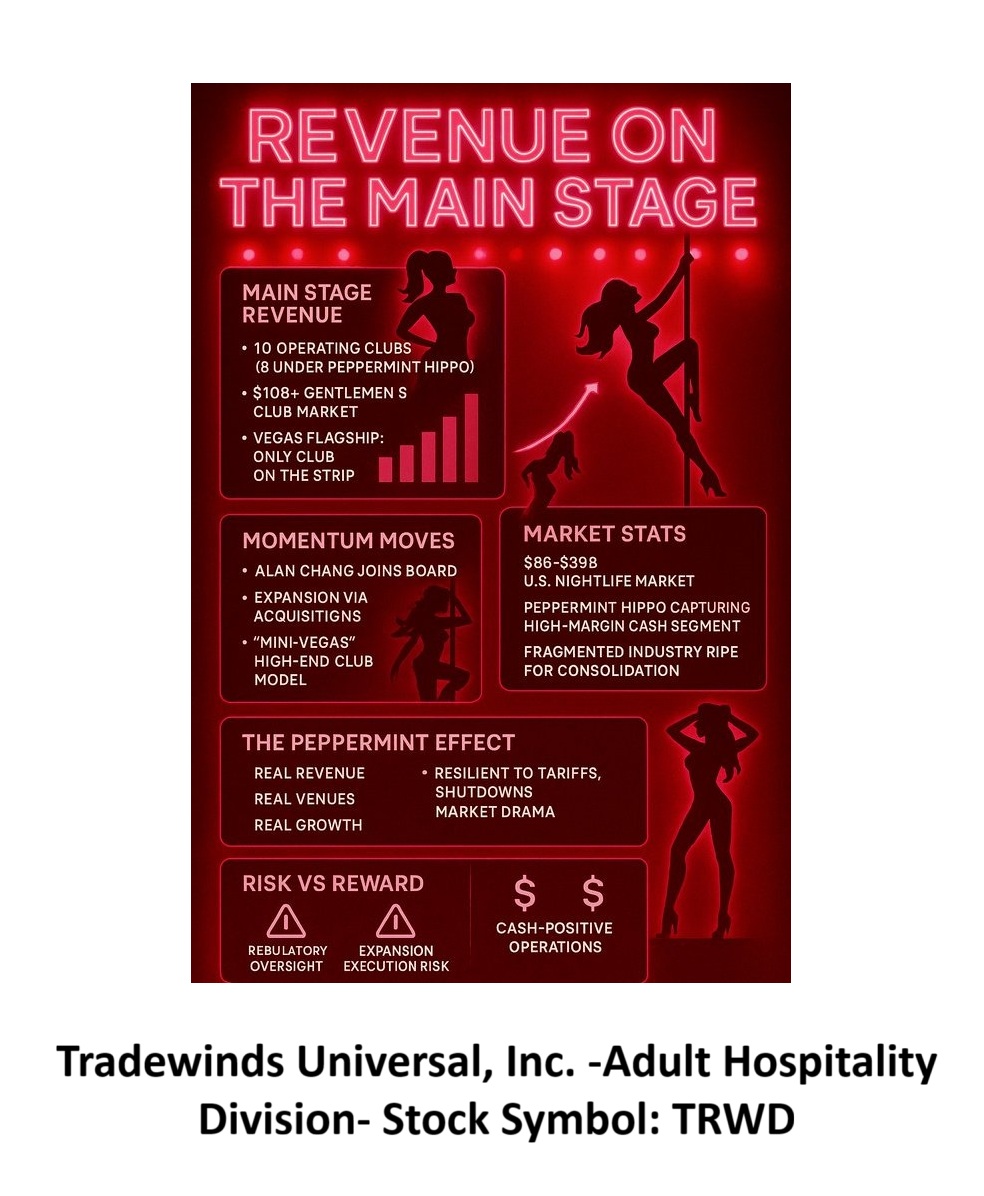

BREA, Calif. - PrAtlas -- In a move that is catching the eye of institutional investors, Tradewinds Universal, Inc. (Stock Symbol: $TRWD) has unveiled a bold and highly scalable plan to consolidate and modernize one of America's most fragmented yet profitable sectors — adult nightlife. And they're doing it with the backing of one of the fastest-growing brands in the space: Peppermint Hippo™.

With a strategic roadmap pointing toward an uplisting to N A S D A Q or N Y S E, TRWD's vision is clear: to become the first major national platform in the $8 billion gentlemen's club niche by acquiring, upgrading, and operating clubs under the Peppermint Hippo brand — and investors are beginning to take notice.

🔥 A Disruptive Growth Story in the Making

TRWD has signed a Letter of Intent (LOI) with Peppermint Hippo™ to acquire up to eight clubs in the near term, with many more in the pipeline. The first club acquisition — located in Toledo, Ohio — is set to be the flagship of what will become a powerful, branded nightlife division within TRWD.

But this isn't a simple roll-up strategy. Under the leadership of Alan Chang, CEO of Peppermint Hippo and Director at TRWD, the company plans to scale to 100+ clubs nationwide, transforming locally run establishments into high-end, Mini-Vegas-style experiences that combine luxury aesthetics, streamlined operations, and brand consistency.

🎙️ "Our vision is to take a highly profitable but disjointed industry and apply brand discipline, professional management, and scalability," says Alan Chang in his exclusive BizTrendWatch interview, now live on YouTube. Watch here

More on PrAtlas

💡 Why Investors Are Paying Attention

The U.S. bars and nightlife market is valued between $36–$39 billion annually, and the gentlemen's club segment alone accounts for an estimated $8 billion. Despite high margins, most clubs are owner-operated, with limited branding and low institutional participation.

$TRWD is now positioning itself as one of the only public platforms focused on consolidating and professionalizing this market. That matters — especially for investors looking for exposure to recession-resilient, cash-flow-generating assets.

Here's what sets the TRWD strategy apart:

✅ Tangible, Revenue-Producing Assets

✅ Professional Corporate Governance (SEC/PCAOB Compliant)

✅ Strong Brand Equity with Peppermint Hippo™

✅ Clear Path to Major Exchange Uplisting (N A S D A Q or N Y S E)

✅ Operational Infrastructure Already in Motion

🎯 Strategic Rollout: From Niche to Nationwide

The upcoming acquisitions will be part of a new Adult Hospitality Division under TRWD. This unit will incorporate Peppermint Hippo clubs and affiliated brands, creating a vertically integrated nightlife empire with centralized marketing, infrastructure, and financial reporting.

According to TRWD's latest update, the company is currently:

🎥 A recent corporate update video highlights the company's aggressive yet disciplined approach. Watch it here

👀 The Only Public Peer? RCI Hospitality ($RICK)

TRWD's expansion and the Peppermint Hippo model will soon be analyzed against RCI Hospitality Holdings (N A S D A Q: RICK) — currently the only significant public company in the space. A forthcoming analyst comparison report by BizTrendWatch is expected to give investors clear context into valuation, strategy, and growth potential.

More on PrAtlas

🧠 Big Vision: Building a Conglomerate, Not Just Clubs

Beyond gentlemen's clubs, (Stock Symbol: $TRWD) envisions building a broader nightlife and entertainment conglomerate, incorporating complementary brands that share operations, data, and marketing platforms — a multi-brand, multi-venue powerhouse akin to a publicly traded version of a hospitality unicorn.

"Our goal is to redefine adult hospitality as an asset-backed, institutional-grade business model — not just entertainment," Chang emphasizes.

🚀 Key Takeaways for Investors

📲 Stay Informed

📢 Follow TRWD on X (Twitter): @OfficialTRWD

📎 Learn more at: https://tradewindsuniversal.com/

📧 Investor Contact: IR@tradewindsuniversal.com

📞 Phone: (619) 483-1008

Bottom Line:

$TRWD isn't just buying clubs — it's building a national brand. With proven leadership, real assets, and a clear roadmap to public market expansion, TRWD represents one of the most compelling growth stories in the overlooked but lucrative adult hospitality space.

Investors looking for cash flow, consolidation, and brand-scale potential may want to keep TRWD on their radar — before the uplisting bells start ringing.

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a strategic roadmap pointing toward an uplisting to N A S D A Q or N Y S E, TRWD's vision is clear: to become the first major national platform in the $8 billion gentlemen's club niche by acquiring, upgrading, and operating clubs under the Peppermint Hippo brand — and investors are beginning to take notice.

🔥 A Disruptive Growth Story in the Making

TRWD has signed a Letter of Intent (LOI) with Peppermint Hippo™ to acquire up to eight clubs in the near term, with many more in the pipeline. The first club acquisition — located in Toledo, Ohio — is set to be the flagship of what will become a powerful, branded nightlife division within TRWD.

But this isn't a simple roll-up strategy. Under the leadership of Alan Chang, CEO of Peppermint Hippo and Director at TRWD, the company plans to scale to 100+ clubs nationwide, transforming locally run establishments into high-end, Mini-Vegas-style experiences that combine luxury aesthetics, streamlined operations, and brand consistency.

🎙️ "Our vision is to take a highly profitable but disjointed industry and apply brand discipline, professional management, and scalability," says Alan Chang in his exclusive BizTrendWatch interview, now live on YouTube. Watch here

More on PrAtlas

- London Art Exchange Emerges as a Leading Force in UK Contemporary Art, Elevating Three Artists to Secondary-Market Success

- myLAB Box Expands, Becoming the First and Only At-Home Testing Company to Serve the Entire Family—Human and Furry—with New Pet Intolerance Test

- Entering 2026 with Expanding Footprint, Strong Industry Tailwinds, and Anticipated Q3 Results: Off The Hook YS Inc. (N Y S E American: OTH)

- Tiger-Rock Martial Arts Appoints Jami Bond as Vice President of Growth

- Super League (N A S D A Q: SLE) Enters Breakout Phase: New Partnerships, Zero Debt & $20 Million Growth Capital Position Company for 2026 Acceleration

💡 Why Investors Are Paying Attention

The U.S. bars and nightlife market is valued between $36–$39 billion annually, and the gentlemen's club segment alone accounts for an estimated $8 billion. Despite high margins, most clubs are owner-operated, with limited branding and low institutional participation.

$TRWD is now positioning itself as one of the only public platforms focused on consolidating and professionalizing this market. That matters — especially for investors looking for exposure to recession-resilient, cash-flow-generating assets.

Here's what sets the TRWD strategy apart:

✅ Tangible, Revenue-Producing Assets

✅ Professional Corporate Governance (SEC/PCAOB Compliant)

✅ Strong Brand Equity with Peppermint Hippo™

✅ Clear Path to Major Exchange Uplisting (N A S D A Q or N Y S E)

✅ Operational Infrastructure Already in Motion

🎯 Strategic Rollout: From Niche to Nationwide

The upcoming acquisitions will be part of a new Adult Hospitality Division under TRWD. This unit will incorporate Peppermint Hippo clubs and affiliated brands, creating a vertically integrated nightlife empire with centralized marketing, infrastructure, and financial reporting.

According to TRWD's latest update, the company is currently:

- Finalizing due diligence on Peppermint Hippo Toledo

- Progressing through legal, licensing, and regulatory frameworks

- Coordinating SEC and PCAOB-compliant audits

- Preparing for seamless integration into TRWD's public reporting structure

🎥 A recent corporate update video highlights the company's aggressive yet disciplined approach. Watch it here

👀 The Only Public Peer? RCI Hospitality ($RICK)

TRWD's expansion and the Peppermint Hippo model will soon be analyzed against RCI Hospitality Holdings (N A S D A Q: RICK) — currently the only significant public company in the space. A forthcoming analyst comparison report by BizTrendWatch is expected to give investors clear context into valuation, strategy, and growth potential.

More on PrAtlas

- Finland's Gambling Reform Promises "Single-Click" Block for All Licensed Sites

- Private Keys Are a Single Point of Failure: Security Advisor Gideon Cohen Warns MPC Technology Is Now the Only Defense for Institutional Custody

- Compliance Is the Ticket to Entry: Legal Advisor Gabriela Moraes Analyzes RWA Securitization Paths Under Brazil's New Legislation

- Coalition and CCHR Call on FDA to Review Electroshock Device and Consider a Ban

- Spark Announces 2025 Design Award Winners

🧠 Big Vision: Building a Conglomerate, Not Just Clubs

Beyond gentlemen's clubs, (Stock Symbol: $TRWD) envisions building a broader nightlife and entertainment conglomerate, incorporating complementary brands that share operations, data, and marketing platforms — a multi-brand, multi-venue powerhouse akin to a publicly traded version of a hospitality unicorn.

"Our goal is to redefine adult hospitality as an asset-backed, institutional-grade business model — not just entertainment," Chang emphasizes.

🚀 Key Takeaways for Investors

- Massive Market Opportunity: $36–$39B nightlife market; $8B gentlemen's club niche

- Peppermint Hippo Brand: Already proven with existing club network and loyal following

- Public Company Advantage: Institutional access, transparency, scale

- Path to N A S D A Q / N Y S E: Emphasis on revenue-generating, tangible assets supports major exchange uplisting

- Strong Leadership: CEO Alan Chang brings brand expertise and national vision

📲 Stay Informed

📢 Follow TRWD on X (Twitter): @OfficialTRWD

📎 Learn more at: https://tradewindsuniversal.com/

📧 Investor Contact: IR@tradewindsuniversal.com

📞 Phone: (619) 483-1008

Bottom Line:

$TRWD isn't just buying clubs — it's building a national brand. With proven leadership, real assets, and a clear roadmap to public market expansion, TRWD represents one of the most compelling growth stories in the overlooked but lucrative adult hospitality space.

Investors looking for cash flow, consolidation, and brand-scale potential may want to keep TRWD on their radar — before the uplisting bells start ringing.

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on PrAtlas

- 6 Holiday Looks That Scream "Old Money" But Cost Less Than Your Christmas Tree

- From Cheer to Courtroom: The Hidden Legal Risks in Your Holiday Eggnog

- Controversial Vegan Turns Rapper Launches First Song, "Psychopathic Tendencies."

- Inside the Fight for Affordable Housing: Avery Headley Joins Terran Lamp for a Candid Bronx Leadership Conversation

- Canterbury Hotel Group Announces the Opening of the TownePlace Suites by Marriott Portland Airport

- Heritage at South Brunswick's Resort-Style Amenities for Any Age and Every Lifestyle

- T-TECH Partners with Japan USA Precision Tools for 2026 US Market Development of the New T-TECH 5-Axis QUICK MILL™

- Record Revenues, Debt-Free Momentum & Shareholder Dividend Ignite Investor Attention Ahead of 2026–2027 Growth Targets: IQSTEL (N A S D A Q: IQST)

- New YouTube Channel Pair Launches to Bring Entertainment Nostalgia Back to Life

- BRAG Hosts Holiday Benefit — Awards 10 Student Scholarships & Honors Timberland with the Corporate Impact Award

- FittingPros Launches Industry's First Data-Driven Golf Club Fitting Directory

- Take Control of Your Color Matching with Boston Industrial Solutions' Newly Expanded Natron® UVPX Series Ink Colors

- "Dr. Vincent Michael Malfitano Expands Monterey–Sicily Cultural Diplomacy With Major International Media Engagement"

- Kaufman Development Breaks Ground on Detroit Micro Data Center, Expanding Its National AI Platform

- Cummings Graduate Institute for Behavioral Health Studies Celebrates New DBH Graduates

- $80M+ Backlog as Florida Statewide Contract, Federal Wins, and Strategic Alliance Fuel Next Phase of AI-Driven Cybersecurity Growth: Cycurion $CYCU

- High-Conviction CNS Disruptor Aiming to Transform Suicidal Depression, Ketamine Therapeutics, and TMS - Reaching Millions by 2030

- Top10Christmas.co.uk Releases the UK Christmas Toy Trends 2025 Report

- Talagat Business Academy Announces Joint Certificate Program With The University of Chicago Booth School of Business

- LocaXion and Asseco CEIT Announce First-to-Market RTLS-Driven Digital Twin Platform for Healthcare, Manufacturing, and Logistics