Trending...

- Roshni Online Services Unveils Plans for Innovative Digital Consultation Platform

- Blasting Off with Space Sector Companies: Artemis II Manned Moon Mission is Set to Launch: Could $ASTI be on the Same Rocket Ride as $ASTS & $LUNR?

- NASA / Glenn Research Center Collaboration to Help Meet Rising Demand for Space Energy Beaming Tech / CIGS PV Modules from Ascent Solar: NAS DAQ: ASTI

One of the Nation's Largest Pre-Owned Boat Dealers Targets Expansion, Technology Leadership, and Luxury Brokerage Growth. OTH Has Locations in Multiple States Including Newest in Florida to Serve as Headquarters for Luxury Brokerage Division

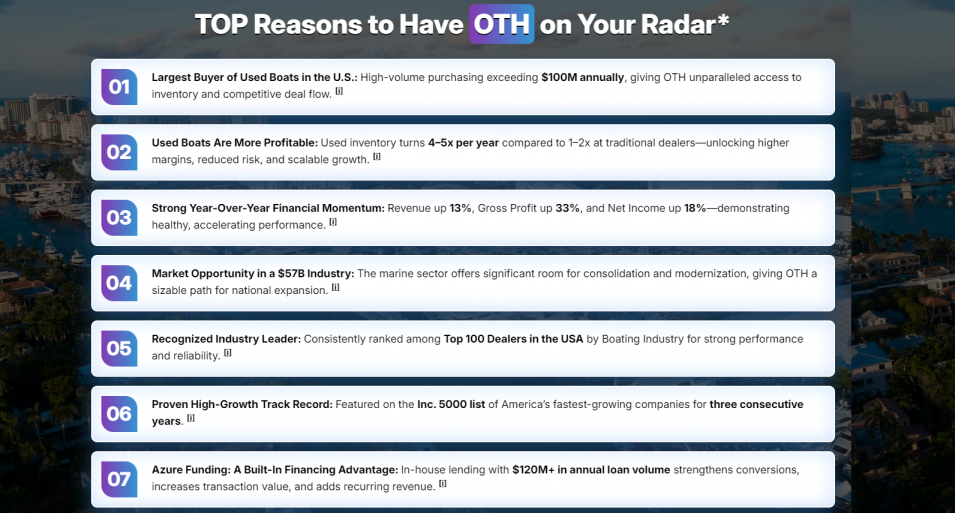

WILMINGTON, N.C. - PrAtlas -- The U.S. marine industry—valued at more than $57 billion—is entering a period of sustained growth, and Off The Hook YS Inc. (NYSE American: OTH) is positioning itself as a major beneficiary. Founded in 2012 and now one of the largest buyers and sellers of pre-owned boats in the country, OTH has built a scalable, tech-enabled platform aimed at modernizing an industry ripe for disruption.

With a national footprint, expanding luxury brokerage operations, strong technology adoption, and a fresh infusion of capital from its November 2025 IPO, OTH is targeting accelerated growth in one of America's most resilient recreation markets.

A National Marine Powerhouse Built on Speed, Scale, and Technology

From its headquarters in Wilmington, North Carolina, OTH has become a dominant force in the pre-owned boat sector. The company:

As consumer demand continues shifting into digital and hybrid sales environments, OTH's technology-focused model allows customers to buy or sell vessels faster and with clearer pricing than many traditional brokerages.

More on PrAtlas

Expanding Into a $57 Billion U.S. Marine Market—Plus a High-Growth Repair Segment

The broader U.S. marine industry—including boats, yachts, accessories, and services—represents a $57 billion market. OTH is strategically positioned to capture share through wholesale buying, brokerage services, inventory turnover, and premium yacht sales.

Further complementing this opportunity is the rapidly expanding U.S. Ship Repair and Maintenance Services Market, which:

This steady, long-term growth trajectory gives OTH multiple avenues for operational and revenue expansion beyond traditional brokerage.

New Jupiter, Florida Headquarters for Luxury Brokerage Division

On November 25, OTH announced a major milestone: the development of a new office in Jupiter, Florida, which will serve as headquarters for Autograph Yacht Group (AYG)—the company's recently launched luxury brokerage division led by industry veteran Mike Burke.

The Jupiter location includes:

The facility sits in one of the most active yachting corridors in the United States, giving AYG immediate access to a high-value customer base.

"We expect the build-out of this location to be completed and move-in ready in the beginning of 2026," said Brian S. John, CEO of OTH. "The location will also have six boat slips for some of our best inventory."

The expansion represents a critical step in OTH's long-term strategy to build a luxury-focused, nationally recognized yacht brokerage brand.

More on PrAtlas

Successful Initial Public Offering Raises $15 Million

On November 14, Off The Hook YS Inc. closed its initial public offering of 3,750,000 shares of common stock at $4.00 per share, generating $15 million in gross proceeds before underwriting fees and expenses. The underwriters were also granted a 45-day option to purchase an additional 562,500 shares to cover over-allotments.

Use of proceeds includes:

ThinkEquity served as sole book-running manager for the transaction.

The successful IPO gives OTH the capital flexibility to scale inventory, expand locations, invest in technology, and accelerate growth through 2025 and beyond.

A Company Positioned for Strong Long-Term Growth

With a proven acquisition engine, expanding national footprint, strong leadership team, and a differentiated technology platform, Off The Hook YS Inc. is emerging as a key consolidator in a fragmented market.

The company is now strategically aligned to capitalize on:

For investors seeking a company with both established scale and high-growth potential, OTH represents an emerging opportunity at the intersection of recreation, technology, and marine services.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Media Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Websites:

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a national footprint, expanding luxury brokerage operations, strong technology adoption, and a fresh infusion of capital from its November 2025 IPO, OTH is targeting accelerated growth in one of America's most resilient recreation markets.

A National Marine Powerhouse Built on Speed, Scale, and Technology

From its headquarters in Wilmington, North Carolina, OTH has become a dominant force in the pre-owned boat sector. The company:

- Acquires more than $100 million annually in boats and yachts

- Operates a nationwide network of offices and marinas across multiple states

- Leverages AI-assisted valuation tools and a data-driven sales platform to bring speed, accuracy, and transparency to transactions

- Has been repeatedly recognized by the Inc. 500 and ranked among the Top 100 Dealers in the USA

As consumer demand continues shifting into digital and hybrid sales environments, OTH's technology-focused model allows customers to buy or sell vessels faster and with clearer pricing than many traditional brokerages.

More on PrAtlas

- Hoy Law Wins Supreme Court Decision Establishing Federal Trucking Regulations as the Standard of Care in South Dakota

- Dr. Rashad Richey's Indisputable Shatters Records, Over 1 Billion YouTube Views, Top 1% Podcast, 3.2 Million Viewers Daily

- Grand Opening: New Single-Family Homes Now Open for Sale at Heritage at Manalapan

- Shelter Structures America Announces Distribution Partnership with The DuraTrac Group

- The OpenSSL Corporation Releases Its Annual Report 2025

Expanding Into a $57 Billion U.S. Marine Market—Plus a High-Growth Repair Segment

The broader U.S. marine industry—including boats, yachts, accessories, and services—represents a $57 billion market. OTH is strategically positioned to capture share through wholesale buying, brokerage services, inventory turnover, and premium yacht sales.

Further complementing this opportunity is the rapidly expanding U.S. Ship Repair and Maintenance Services Market, which:

- Is valued at $6.55 billion in 2025

- Is projected to reach $11.72 billion by 2033

- Is growing at a 7.52% CAGR

This steady, long-term growth trajectory gives OTH multiple avenues for operational and revenue expansion beyond traditional brokerage.

New Jupiter, Florida Headquarters for Luxury Brokerage Division

On November 25, OTH announced a major milestone: the development of a new office in Jupiter, Florida, which will serve as headquarters for Autograph Yacht Group (AYG)—the company's recently launched luxury brokerage division led by industry veteran Mike Burke.

The Jupiter location includes:

- Newly built office space

- Six dedicated boat slips for high-end inventory

- Space to house members of OTH's Florida-based C-suite

The facility sits in one of the most active yachting corridors in the United States, giving AYG immediate access to a high-value customer base.

"We expect the build-out of this location to be completed and move-in ready in the beginning of 2026," said Brian S. John, CEO of OTH. "The location will also have six boat slips for some of our best inventory."

The expansion represents a critical step in OTH's long-term strategy to build a luxury-focused, nationally recognized yacht brokerage brand.

More on PrAtlas

- Iranian-Born Engineer Mohsen Bahmani Introduces Propeller-Less Propulsion for Urban Air Mobility

- Aleen Inc. (C S E: ALEN.U) Advances Digital Wellness Vision with Streamlined Platform Navigation and Long-Term Growth Strategy

- RimbaMindaAI Officially Launches Version 3.0 Following Strategic Breakthrough in Malaysian Market Analysis

- Fed Rate Pause & Dow 50k: Irfan Zuyrel on Liquidity Shifts, Crypto Volatility, and the ASEAN Opportunity

- 20/20 Institute Launches Updated Vision Correction Procedures Page for Denver & Colorado Springs

Successful Initial Public Offering Raises $15 Million

On November 14, Off The Hook YS Inc. closed its initial public offering of 3,750,000 shares of common stock at $4.00 per share, generating $15 million in gross proceeds before underwriting fees and expenses. The underwriters were also granted a 45-day option to purchase an additional 562,500 shares to cover over-allotments.

Use of proceeds includes:

- Servicing its floorplan

- Enhanced marketing and advertising efforts

- Repayment of a promissory note

- General working capital

ThinkEquity served as sole book-running manager for the transaction.

The successful IPO gives OTH the capital flexibility to scale inventory, expand locations, invest in technology, and accelerate growth through 2025 and beyond.

A Company Positioned for Strong Long-Term Growth

With a proven acquisition engine, expanding national footprint, strong leadership team, and a differentiated technology platform, Off The Hook YS Inc. is emerging as a key consolidator in a fragmented market.

The company is now strategically aligned to capitalize on:

- A massive and growing U.S. marine economy

- Continued consumer demand for pre-owned boats and luxury yachts

- Digital transformation within the brokerage sector

- Rising demand in the marine repair and maintenance industry

- Expansion into high-value boating markets like Florida

For investors seeking a company with both established scale and high-growth potential, OTH represents an emerging opportunity at the intersection of recreation, technology, and marine services.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Media Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Websites:

- www.offthehookyachts.com

- https://compasslivemedia.com/oth/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on PrAtlas

- Mend Colorado Launches Revamped Sports Performance Training Page

- Parkway Prosthodontics Achieves Breakthrough Full-Arch Reconstruction Case

- Postmortem Pathology Expands to Phoenix: Bringing Families Answers During Their Most Difficult Moments

- Blasting Off with Space Sector Companies: Artemis II Manned Moon Mission is Set to Launch: Could $ASTI be on the Same Rocket Ride as $ASTS & $LUNR?

- Costa Oil Named Primary Sponsor of Carson Ware for the United Rentals 300 at Daytona International Speedway

- HBMHCW Expande Infraestructura de Cumplimiento para Argentina mientras América Latina Supera $1.5 Billones en Volumen Cripto

- Norisia Launches AI Formulated Luxury Multivitamin to Transform Daily Wellness in the UK

- FPFX Tech & PropAccount.com Partner with Investing Expos to Advance the Global Prop Trading Industry

- Jacob Emrani's Annual "Supper Bowl" Expected To Donate Thousands Of Meals

- NASA / Glenn Research Center Collaboration to Help Meet Rising Demand for Space Energy Beaming Tech / CIGS PV Modules from Ascent Solar: NAS DAQ: ASTI

- When Interpretation Becomes Conversation: Rethinking Engagement in the Museum Age

- Half of Finnish Online Gambling Expenditure Now Flows to Offshore Instant Casinos as License Applications Open March 1, 2026

- RTC Communications Completes Next Level Connect Fiber Expansion Bringing Multi-Gig Broadband to West Boggs Community

- EPP Pricing Platform announces leadership transition to support long-term growth and continuity

- Stolen Hearts: Reclaiming Your Child From Parental Alienation (narcissistic abuse)

- Roshni Online Services Unveils Plans for Innovative Digital Consultation Platform

- Wall Street Is Missing This One: Cycurion (NAS DAQ: CYCU) Gets $7 Price Target While Trading at a Steep Discount

- Aries Industries Streamlines Sewer Inspection Process With Introduction of the LETS Sidewinder

- Chronic Boss Awards Scholarships to Student Founders Living with Chronic Conditions

- Nest Finders Property Management Named #1 in Jacksonville and Ranked #99 Nationwide