Trending...

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

- Tarrytown Expocare Pharmacy Announces Strategic Leadership Appointments to Accelerate Growth and Innovation

- Jason Caras Launches The Caras Institute Following Successful Exit from IT Authorities

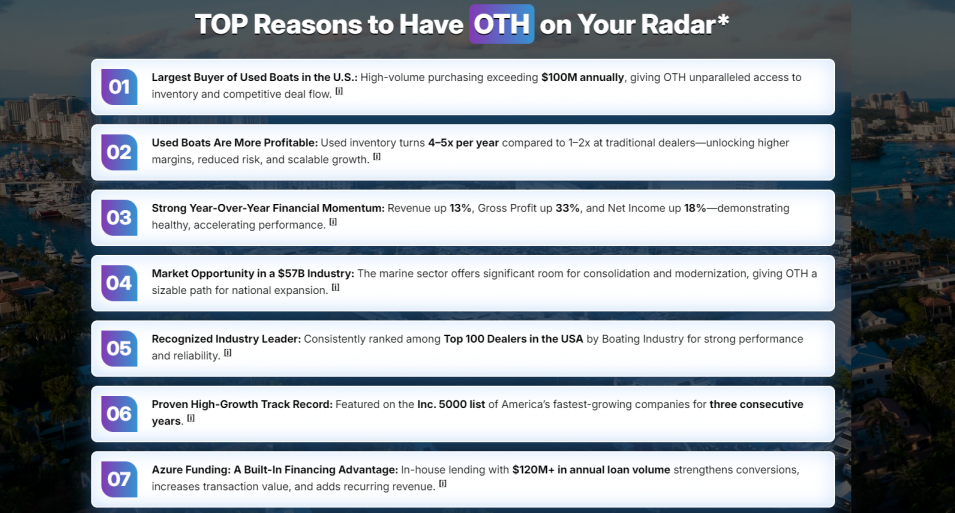

Off The Hook YS Inc. (NYSE American: OTH) $OTH is A Technology-Driven Marine Platform Poised for a Breakout Year

WILMINGTON, N.C. - PrAtlas -- In an industry long dominated by fragmented dealers and opaque transactions, Off The Hook YS, Inc. (NYSE American: OTH) is quietly building what many investors now recognize as a category-defining platform in the $57 billion U.S. marine industry.

Founded in 2012 by industry veteran Jason Ruegg, Off The Hook has evolved into one of America's largest buyers and sellers of pre-owned boats and yachts, acquiring more than $100 million in vessels annually and operating a nationwide network of offices and marinas across multiple states. Following its successful 2025 IPO, OTH has entered 2026 with accelerating momentum, expanding inventory capacity, international reach, and growing validation from institutional research.

$100 Million in New Listings and a Rapidly Scaling Luxury Platform

One of the most compelling recent developments is the breakout performance of Autograph Yacht Group, OTH's newly launched luxury brokerage division.

Autograph focuses on yachts ranging from $500,000 to $20 million+, offering a boutique, high-touch brokerage experience while leveraging OTH's proprietary AI-driven valuation and matching engine. Unlike traditional luxury brokerages, Autograph can seamlessly accept trade-ins—unlocking liquidity and accelerating deal velocity in a segment historically resistant to innovation.

This early traction underscores the scalability of OTH's vertically integrated model and highlights its ability to move upstream into higher-margin market segments without sacrificing speed or transparency.

Strategic Expansion into the Caribbean & Latin America

On January 26, OTH announced a strategic agreement with CFR Yacht Sales, a leading yacht dealer and brokerage based in San Juan, Puerto Rico. The partnership marks OTH's first major step into the Caribbean and Latin American markets, regions known for strong demand in premium pre-owned vessels and limited institutional infrastructure.

More on PrAtlas

Under the agreement:

This expansion builds directly on OTH's core strength—efficiently aggregating, valuing, and distributing pre-owned inventory—while opening new international supply channels that can materially increase deal flow in 2026 and beyond.

Inventory Financing Expanded to $60 Million: Fuel for Accelerated Growth

On January 20, OTH announced a major expansion of its inventory financing floorplan to $60 million, more than doubling capacity from pre-IPO levels. This move significantly enhances OTH's ability to acquire and carry high-quality used inventory across key geographies and categories.

The impact is meaningful:

In a supply-constrained market, capital access and inventory intelligence are decisive advantages—and OTH now has both at scale.

Dealer Engagement Reinvented: flyExclusive Partnership

On January 15, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the nation's leading private aviation operators.

High-performing dealer partners can now earn private aviation flight hours as part of a performance-based incentive structure—an innovative reward aligned with the lifestyle and efficiency demands of top marine professionals.

By blending marine and aviation platforms at a national scale, OTH is deepening dealer loyalty, increasing intake volume, and further differentiating its acquisition network.

Share Buyback Signals Management Confidence

On January 8, OTH's Board authorized a share repurchase program of up to $1 million, signaling management's view that the current stock price does not reflect the company's intrinsic value.

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead,"

More on PrAtlas

— Brian John, Chief Executive Officer

The buyback will be funded through existing cash and future cash flows, while OTH continues investing in inventory expansion, technology, and strategic growth initiatives—underscoring disciplined, shareholder-aligned capital allocation.

Strong Financial Trajectory in a Growing Market

For the first nine months of 2025, OTH reported record revenue of $82.6 million, representing 19.3% year-over-year growth. Looking ahead, management projects 2026 revenue between $140 million and $145 million, driven by:

Beyond boat sales, OTH is well positioned to benefit from long-term industry tailwinds, including the U.S. Ship Repair and Maintenance Services Market, projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033 at a 7.52% CAGR.

Institutional Validation: Think Equity Initiates Coverage

In January 2026, Think Equity initiated coverage on OTH with a $10 per share price target, highlighting what it views as a disconnect between market valuation and business fundamentals.

"OTH represents a unique opportunity to acquire a high-growth platform trading at a distressed valuation. With a verified revenue trajectory toward $145 million, a proven technology-driven model, and shareholder-aligned capital allocation, OTH is poised for a significant re-rating."

This initiation provides third-party validation of OTH's strategy, execution, and long-term upside.

The Bottom Line

Off The Hook YS, Inc. is no longer just a successful boat dealer—it is rapidly becoming a technology-enabled marine commerce platform with national scale, international expansion, and multiple embedded growth engines.

With:

OTH enters 2026 positioned for what could be its most transformative year yet.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Founded in 2012 by industry veteran Jason Ruegg, Off The Hook has evolved into one of America's largest buyers and sellers of pre-owned boats and yachts, acquiring more than $100 million in vessels annually and operating a nationwide network of offices and marinas across multiple states. Following its successful 2025 IPO, OTH has entered 2026 with accelerating momentum, expanding inventory capacity, international reach, and growing validation from institutional research.

$100 Million in New Listings and a Rapidly Scaling Luxury Platform

One of the most compelling recent developments is the breakout performance of Autograph Yacht Group, OTH's newly launched luxury brokerage division.

- $100 million in secured listings

- 22 closed transactions totaling $35 million

- Achieved within the first quarter of operations since its October launch

Autograph focuses on yachts ranging from $500,000 to $20 million+, offering a boutique, high-touch brokerage experience while leveraging OTH's proprietary AI-driven valuation and matching engine. Unlike traditional luxury brokerages, Autograph can seamlessly accept trade-ins—unlocking liquidity and accelerating deal velocity in a segment historically resistant to innovation.

This early traction underscores the scalability of OTH's vertically integrated model and highlights its ability to move upstream into higher-margin market segments without sacrificing speed or transparency.

Strategic Expansion into the Caribbean & Latin America

On January 26, OTH announced a strategic agreement with CFR Yacht Sales, a leading yacht dealer and brokerage based in San Juan, Puerto Rico. The partnership marks OTH's first major step into the Caribbean and Latin American markets, regions known for strong demand in premium pre-owned vessels and limited institutional infrastructure.

More on PrAtlas

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

Under the agreement:

- OTH gains preferred access to select brokerage and trade-generated vessels

- CFR supports sourcing, verification, logistics, and regional wholesale visibility

- OTH gains access to brokerage facilities and inventory in Puerto Rico

This expansion builds directly on OTH's core strength—efficiently aggregating, valuing, and distributing pre-owned inventory—while opening new international supply channels that can materially increase deal flow in 2026 and beyond.

Inventory Financing Expanded to $60 Million: Fuel for Accelerated Growth

On January 20, OTH announced a major expansion of its inventory financing floorplan to $60 million, more than doubling capacity from pre-IPO levels. This move significantly enhances OTH's ability to acquire and carry high-quality used inventory across key geographies and categories.

The impact is meaningful:

- Broader selection drives higher conversion rates

- Increased inventory improves turn times and pricing power

- AI-assisted matching accelerates transaction velocity

- Vertical integration enables value-added upsells such as financing, insurance, and warranties

In a supply-constrained market, capital access and inventory intelligence are decisive advantages—and OTH now has both at scale.

Dealer Engagement Reinvented: flyExclusive Partnership

On January 15, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the nation's leading private aviation operators.

High-performing dealer partners can now earn private aviation flight hours as part of a performance-based incentive structure—an innovative reward aligned with the lifestyle and efficiency demands of top marine professionals.

By blending marine and aviation platforms at a national scale, OTH is deepening dealer loyalty, increasing intake volume, and further differentiating its acquisition network.

Share Buyback Signals Management Confidence

On January 8, OTH's Board authorized a share repurchase program of up to $1 million, signaling management's view that the current stock price does not reflect the company's intrinsic value.

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead,"

More on PrAtlas

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

— Brian John, Chief Executive Officer

The buyback will be funded through existing cash and future cash flows, while OTH continues investing in inventory expansion, technology, and strategic growth initiatives—underscoring disciplined, shareholder-aligned capital allocation.

Strong Financial Trajectory in a Growing Market

For the first nine months of 2025, OTH reported record revenue of $82.6 million, representing 19.3% year-over-year growth. Looking ahead, management projects 2026 revenue between $140 million and $145 million, driven by:

- Expanded inventory capacity

- International sourcing channels

- Luxury brokerage momentum

- Dealer engagement initiatives

- Continued adoption of AI-assisted valuation tools

Beyond boat sales, OTH is well positioned to benefit from long-term industry tailwinds, including the U.S. Ship Repair and Maintenance Services Market, projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033 at a 7.52% CAGR.

Institutional Validation: Think Equity Initiates Coverage

In January 2026, Think Equity initiated coverage on OTH with a $10 per share price target, highlighting what it views as a disconnect between market valuation and business fundamentals.

"OTH represents a unique opportunity to acquire a high-growth platform trading at a distressed valuation. With a verified revenue trajectory toward $145 million, a proven technology-driven model, and shareholder-aligned capital allocation, OTH is poised for a significant re-rating."

This initiation provides third-party validation of OTH's strategy, execution, and long-term upside.

The Bottom Line

Off The Hook YS, Inc. is no longer just a successful boat dealer—it is rapidly becoming a technology-enabled marine commerce platform with national scale, international expansion, and multiple embedded growth engines.

With:

- $100M+ annual vessel acquisitions

- $60M inventory capacity

- AI-powered valuation and matching

- Luxury brokerage traction

- International expansion

- Shareholder-friendly capital actions

OTH enters 2026 positioned for what could be its most transformative year yet.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on PrAtlas

- Progressive Dental & The Closing Institute Partner with Zest Dental Solutions to Elevate Full-Arch Growth and Patient Outcomes

- Spring Surge in 55+ Communities: What Buyers and Sellers Need to Know in 2026

- Jason Caras Launches The Caras Institute Following Successful Exit from IT Authorities

- Serina Damesworth Hired as Century Fasteners Corp. – Director of Quality

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- Distributed Social Media - Own Your Content

- Tarrytown Expocare Pharmacy Announces Strategic Leadership Appointments to Accelerate Growth and Innovation

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

- March Is Skiing's Smartest Buying Window

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

- Tobu Group's "T-home Series" of Accommodations in Tokyo Just Opened "T-home KEI."

- Custom Wooden Token Manufacturer Celebrates 10 Years of Helping Brands Stay Top of Mind

- NaturismRE Launches the NRE Health Institute to Advance Evidence-Informed Public Health Research

- P-Wave Classics to publish Robert Bage's Hermsprong in three volumes, beginning 12 May

- Progressive Dental & The Closing Institute Partner with Zest Dental Solutions to Elevate Full-Arch Growth and Patient Outcomes

- CCHR: While Damaging Antipsychotics Win Approval, Proven Non-Drug Alternatives Remain Ignored

- Arcuri Group Announces Long‑Term Partnership with WakeMed Health & Hospitals to Deliver Situational Awareness and De‑escalation Training

- At 25, She Became One of the Youngest AAPI Female Founders to Win One of the World's Most Prestigious Design Awards for a Lamp That Makes You Smile

- Juego Studios Extends Full-Cycle Game Development & Outsourcing Capabilities to the UAE Market