Trending...

- Wohler announces three SRT monitoring enhancements for its iVAM2-MPEG monitor and the addition of front panel PID selection of A/V/subtitle streams

- Safe Health Zones: A Global Breakthrough to Protect Night-Shift Workers from Preventable Harm

- Torch Entertainment Presents The Frozen Zoo

$IQST Institutions are Buying...Why? IQST is Undervalued at $7

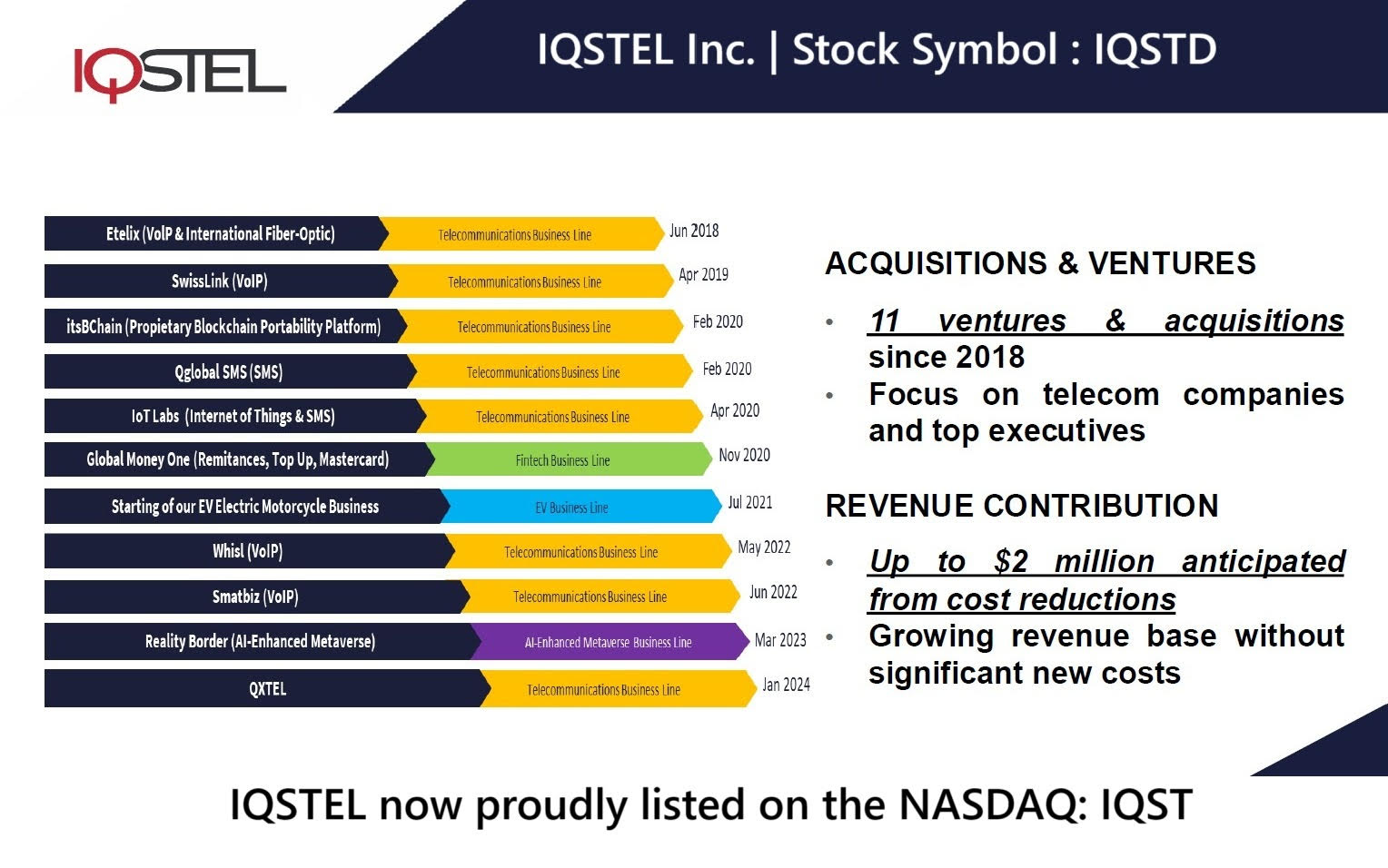

CORAL GABLES, Fla. - PrAtlas -- August 2025 — In a marketplace increasingly defined by rapid innovation, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a rare standout — delivering real revenues, rapid profitability milestones, and strategic diversification across the most exciting sectors in tech: telecom, fintech, electric vehicles, artificial intelligence, and cybersecurity.

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

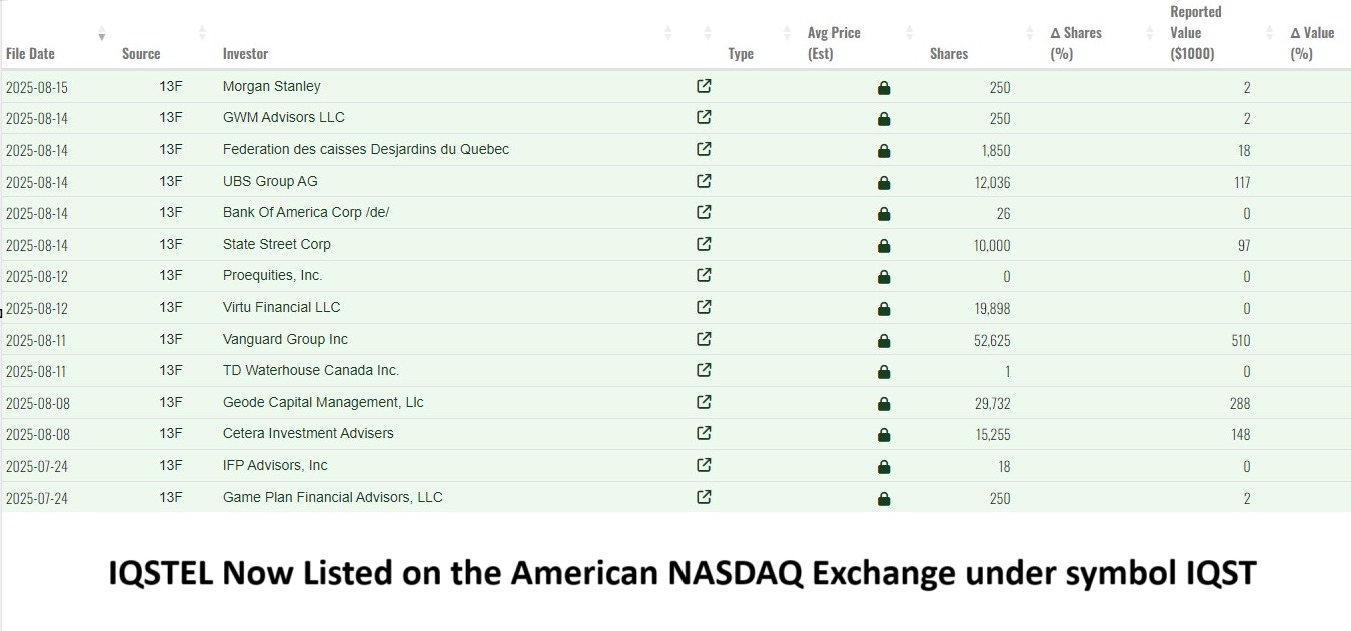

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on PrAtlas

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

Recent Highlights Validating the Strategy

Analyst Endorsement and Institutional Interest Rising

More on PrAtlas

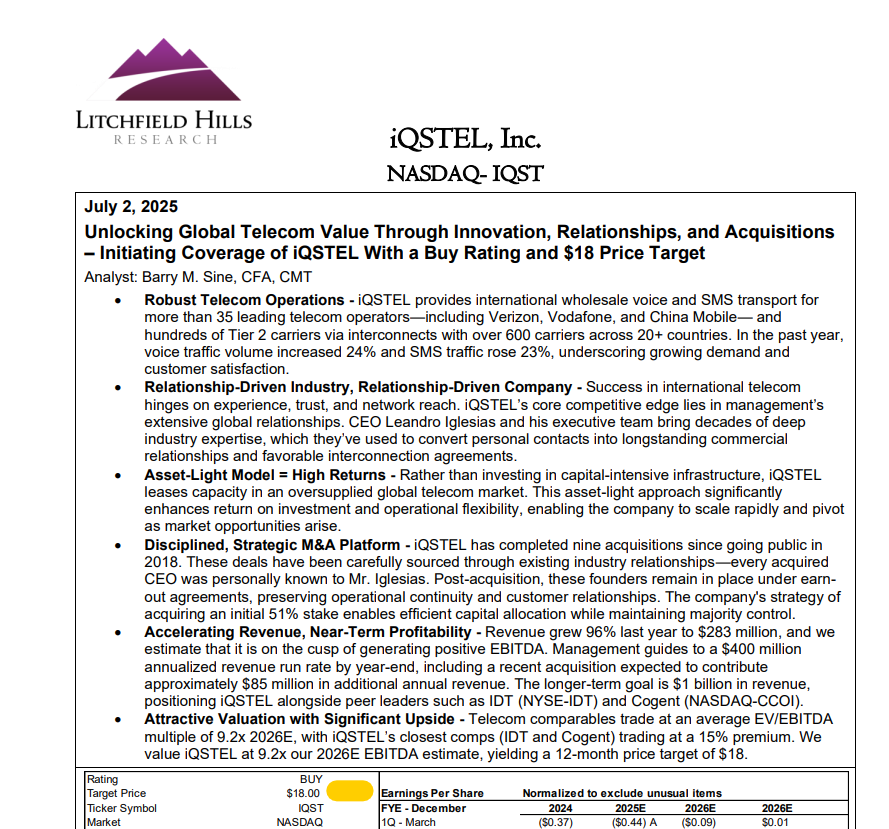

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

- $35M in July revenue alone — puts the company ahead of schedule on its $400M+ run rate

- $17.41 in assets per share, equity per share up to $4.84

- $6.9M in debt eliminated, or nearly $2 per share, strengthening the balance sheet

- Litchfield Hills Research reaffirms $18 price target, citing strong Q2 performance

- New dividend catalyst: IQST shareholders to receive shares in ASII as part of Nasdaq uplisting strategy

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on PrAtlas

- New Smile Now Introduces RAYFace 3D Scanner to Advance Digital Surgery

- Ali Alijanian, DDS Featured in The Profitable Dentist Magazine

- "Meet the Eatmons" Offer Financial Advice ahead of the Holidays

- CCHR: Study Finds Involuntary Commitment Fails to Prevent Suicide, Raises Risk

- Slotozilla's Q3 2025: SBC Lisbon Outcomes and Partnership Expansion

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

- Telecom: $600M+ in historical revenue, strong recurring business, trusted by 600+ operators worldwide

- Fintech: Expansion accelerated by the July 1st acquisition of GlobeTopper, forecasting $34M in H2 revenue and positive EBITDA

- AI: Launch of IQ2Call — an AI-powered, multilingual call center disrupting the $750B global telecom customer service market

- Cybersecurity & Blockchain: Active product development underway to support enterprise and consumer needs globally

Recent Highlights Validating the Strategy

- Q2 2025 Financials (Ended June 30, 2025):

- Gross revenues grew 17% YoY (100% organic growth)

- Gross margin improved by 7.45%

- Net shareholder equity up 20% in 6 months

- Common equity conversions absorbed by the market with no dilution impact

- Equity Exchange and Dividend Partnership with CYCU:

- IQST and CYCU signed an MOU for mutual equity stakes and shareholder dividends in each company — strengthening IQST's shareholder value proposition

Analyst Endorsement and Institutional Interest Rising

More on PrAtlas

- Historic Announcement for the Global Car Rental Industry

- Siembra Brings 18 Latinx Artists Together in Brooklyn Exhibition

- Gramercy Tech Launches StoryStream

- Turbo vs. Experts: Tracking OddsTrader's AI Performance at the NFL's Midpoint

- Outreaching.io Appoints Rameez Ghayas Usmani as CEO, Recognized as Best HARO Link Building Expert in the United States

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business, Technology, Telecom, Stocks, Financial, Finance, Artificial Intelligence, Stock Market, Press Release, Nasdaq, Cybersecurity, Fintech

0 Comments

Latest on PrAtlas

- Sweet Memories Vintage Tees Debuts Historic ORCA™ Beverage Nostalgic Soda Collection

- UK Financial Ltd Celebrates Global Recognition as MayaCat (MCAT) Evolves Into SMCAT — The World's First Meme Coin Under ERC-3643 Compliance

- U.S. Military to Benefit from Drone Tech Agreement with NovaSpark Energy, Plus Longer NASA Space Missions via Solar Power Leader: Ascent Solar $ASTI

- $76 Million in Gold & Silver Holdings and Expanding Production — Pioneering the Future of Gold: Asia Broadband Inc. (Stock Symbol: AABB) is Surging

- Wohler announces three SRT monitoring enhancements for its iVAM2-MPEG monitor and the addition of front panel PID selection of A/V/subtitle streams

- Schemawriter.ai launches WordPress plugin as industry leaders confirm - schema markup is critical

- 20 Million Financing to Accelerate Growth and Advance Digital Asset Strategy Secured for Super League (N A S D A Q: SLE)

- uCAR Trading Launches goldsilbermarkt.de, a New Online Shop for Precious Metals

- Webinar Announcement: Reputational Risk Management in Internal Investigations: Controlling the Narrative Before, During, and After a Crisis

- Taking on the Multi-Billion-Dollar Swipe Industry: AI Curates Who You Meet—IRL over brunch

- Safe Health Zones: A Global Breakthrough to Protect Night-Shift Workers from Preventable Harm

- Cartwheel Signs Letter of Intent to License Clearsight Therapeutics' Novel Pink Eye Treatment for 2027 Portfolio Expansion

- Vet Maps Launches National Platform to Spotlight Veteran-Owned Businesses and Causes

- $114.6 Million in Revenues, Up 54%: Uni-Fuels Holdings (N A S D A Q: UFG) Accelerates Global Expansion Across Major Shipping Hubs as Demand Surges

- Dental Care Solutions Unveils New Website for Enhanced Patient Engagement

- TradingHabits.com Launches to Support Day Trader Well-being

- $750 Million Market on Track to $3.35 Billion by 2034: $NRXP Launches First-in-Florida "One Day" Depression Treatment in Partnership with Ampa Health

- $750 Million Market Set to Soar to $3.35 Billion by 2034 as Florida Launches First-in-Nation One-Day: NRx Pharmaceuticals (N A S D A Q: NRXP) $NRXP

- BITE Data raises $3m to build AI tools for global trade compliance teams

- Phinge Issues Notice of Possible Infringement, Investigates App-less AI Agents & Technology for Unauthorized Use of its Patented App-less Technologies