Trending...

- Wohler announces three SRT monitoring enhancements for its iVAM2-MPEG monitor and the addition of front panel PID selection of A/V/subtitle streams

- Safe Health Zones: A Global Breakthrough to Protect Night-Shift Workers from Preventable Harm

- Torch Entertainment Presents The Frozen Zoo

Colorado-Based Platform Secures Federal Authorization for Digital Asset Trading Services

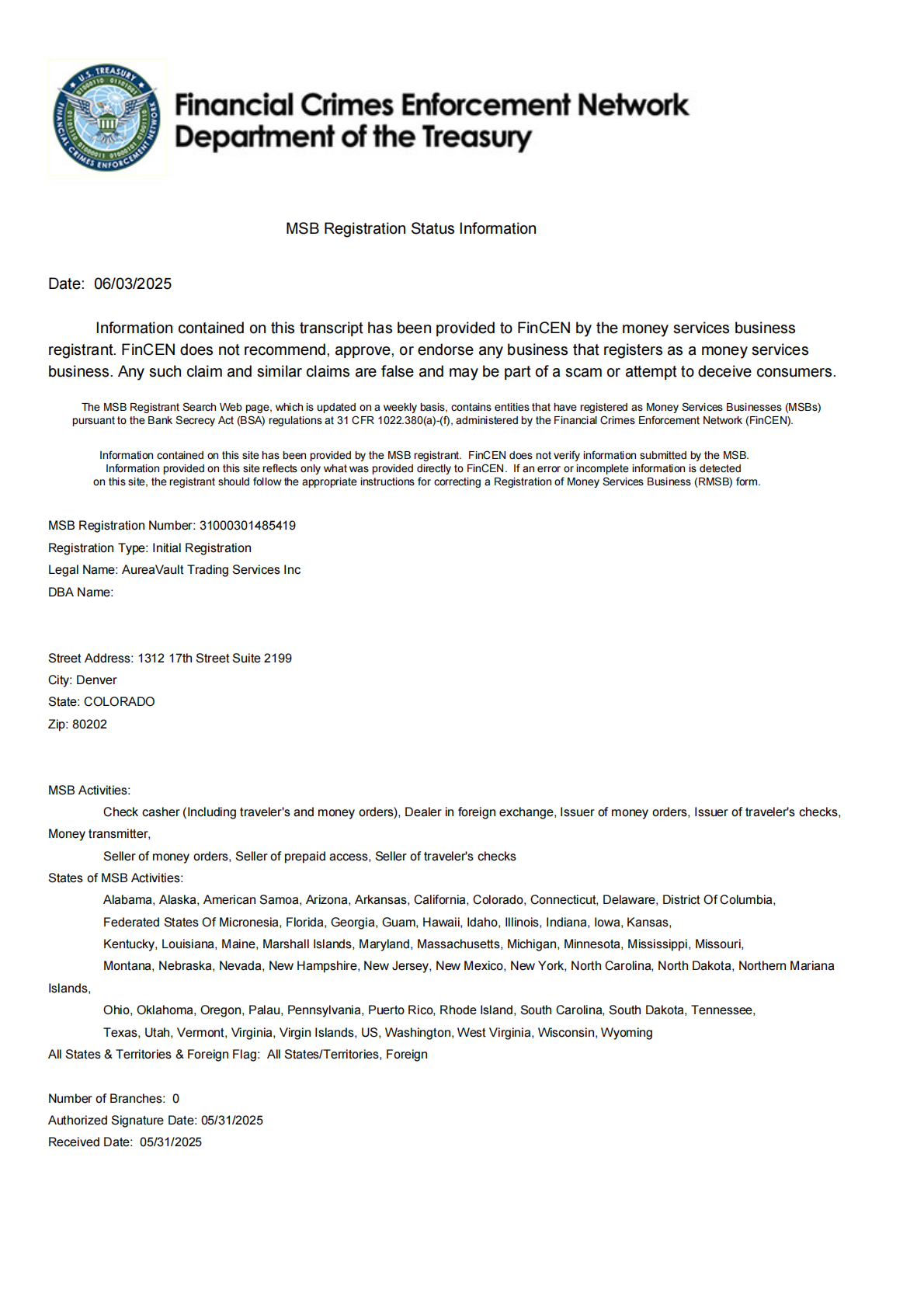

DENVER - PrAtlas -- AureaVault Trading Services Inc., a licensed U.S. cryptocurrency exchange, announced completion of its regulatory framework and platform development for digital asset trading. The company secured Money Services Business registration with the Financial Crimes Enforcement Network, authorizing money transmission across all U.S. states and territories.

The exchange addresses security vulnerabilities, regulatory uncertainty, and complex interfaces limiting cryptocurrency adoption. AureaVault's platform incorporates cold storage architecture, multi-signature protocols, and compliance procedures for retail and institutional users.

"The digital asset industry has matured, but users face challenges around security and regulatory clarity," said Marcus Bellwether, Chief Operating Officer. "Our development focused on solving these issues through compliance frameworks and proven technology."

More on PrAtlas

The company operates under a business model centered on trading commissions, withdrawal fees, and listing fees. AureaVault plans to offer spot trading across major digital asset pairs, with fiat integration through banking partnerships. The platform supports market, limit, and stop-limit orders.

Security infrastructure represents a differentiator. The platform stores user assets in distributed cold storage facilities protected by multi-signature technology. Multi-factor authentication and transaction monitoring provide protection against cybersecurity threats.

The platform implements tiered fee structure rewarding traders with reduced rates based on volume. Users can access charting tools, technical indicators, and portfolio features.

AureaVault's architecture utilizes microservices design for scalability. The infrastructure adjusts resources based on demand to maintain performance. APIs provide connectivity for algorithmic traders and institutional clients.

Revenue strategy encompasses multiple streams beyond trading fees. Future expansion may include staking services and custody solutions.

More on PrAtlas

Regulatory compliance forms AureaVault's foundation. The company maintains Anti-Money Laundering and Know Your Customer procedures. Security audits validate platform controls regularly.

The leadership team combines executives from financial institutions with technology experience. CEO James Peterson brings FinTech experience, CTO Dr. Eleanor Vance contributes systems expertise, and Chief Compliance Officer Sophia Miller provides regulatory experience.

AureaVault plans to launch with Bitcoin and Ethereum support, with additional assets added following due diligence.

About AureaVault

AureaVault Trading Services Inc. operates as a licensed U.S. cryptocurrency exchange headquartered in Denver, Colorado. The company maintains federal Money Services Business authorization for digital asset and money transmission services.

Media Contact: Marcus Bellwether Chief Operating Officer AureaVault Trading Services Inc. Email: marcus.bellwether@ajslkz.com Website: https://www.ajslkz.com/

The exchange addresses security vulnerabilities, regulatory uncertainty, and complex interfaces limiting cryptocurrency adoption. AureaVault's platform incorporates cold storage architecture, multi-signature protocols, and compliance procedures for retail and institutional users.

"The digital asset industry has matured, but users face challenges around security and regulatory clarity," said Marcus Bellwether, Chief Operating Officer. "Our development focused on solving these issues through compliance frameworks and proven technology."

More on PrAtlas

- New Smile Now Introduces RAYFace 3D Scanner to Advance Digital Surgery

- Ali Alijanian, DDS Featured in The Profitable Dentist Magazine

- "Meet the Eatmons" Offer Financial Advice ahead of the Holidays

- CCHR: Study Finds Involuntary Commitment Fails to Prevent Suicide, Raises Risk

- Slotozilla's Q3 2025: SBC Lisbon Outcomes and Partnership Expansion

The company operates under a business model centered on trading commissions, withdrawal fees, and listing fees. AureaVault plans to offer spot trading across major digital asset pairs, with fiat integration through banking partnerships. The platform supports market, limit, and stop-limit orders.

Security infrastructure represents a differentiator. The platform stores user assets in distributed cold storage facilities protected by multi-signature technology. Multi-factor authentication and transaction monitoring provide protection against cybersecurity threats.

The platform implements tiered fee structure rewarding traders with reduced rates based on volume. Users can access charting tools, technical indicators, and portfolio features.

AureaVault's architecture utilizes microservices design for scalability. The infrastructure adjusts resources based on demand to maintain performance. APIs provide connectivity for algorithmic traders and institutional clients.

Revenue strategy encompasses multiple streams beyond trading fees. Future expansion may include staking services and custody solutions.

More on PrAtlas

- Historic Announcement for the Global Car Rental Industry

- Siembra Brings 18 Latinx Artists Together in Brooklyn Exhibition

- Gramercy Tech Launches StoryStream

- Turbo vs. Experts: Tracking OddsTrader's AI Performance at the NFL's Midpoint

- Outreaching.io Appoints Rameez Ghayas Usmani as CEO, Recognized as Best HARO Link Building Expert in the United States

Regulatory compliance forms AureaVault's foundation. The company maintains Anti-Money Laundering and Know Your Customer procedures. Security audits validate platform controls regularly.

The leadership team combines executives from financial institutions with technology experience. CEO James Peterson brings FinTech experience, CTO Dr. Eleanor Vance contributes systems expertise, and Chief Compliance Officer Sophia Miller provides regulatory experience.

AureaVault plans to launch with Bitcoin and Ethereum support, with additional assets added following due diligence.

About AureaVault

AureaVault Trading Services Inc. operates as a licensed U.S. cryptocurrency exchange headquartered in Denver, Colorado. The company maintains federal Money Services Business authorization for digital asset and money transmission services.

Media Contact: Marcus Bellwether Chief Operating Officer AureaVault Trading Services Inc. Email: marcus.bellwether@ajslkz.com Website: https://www.ajslkz.com/

Source: AureaVault

0 Comments

Latest on PrAtlas

- Sweet Memories Vintage Tees Debuts Historic ORCA™ Beverage Nostalgic Soda Collection

- UK Financial Ltd Celebrates Global Recognition as MayaCat (MCAT) Evolves Into SMCAT — The World's First Meme Coin Under ERC-3643 Compliance

- U.S. Military to Benefit from Drone Tech Agreement with NovaSpark Energy, Plus Longer NASA Space Missions via Solar Power Leader: Ascent Solar $ASTI

- $76 Million in Gold & Silver Holdings and Expanding Production — Pioneering the Future of Gold: Asia Broadband Inc. (Stock Symbol: AABB) is Surging

- Wohler announces three SRT monitoring enhancements for its iVAM2-MPEG monitor and the addition of front panel PID selection of A/V/subtitle streams

- Schemawriter.ai launches WordPress plugin as industry leaders confirm - schema markup is critical

- 20 Million Financing to Accelerate Growth and Advance Digital Asset Strategy Secured for Super League (N A S D A Q: SLE)

- uCAR Trading Launches goldsilbermarkt.de, a New Online Shop for Precious Metals

- Webinar Announcement: Reputational Risk Management in Internal Investigations: Controlling the Narrative Before, During, and After a Crisis

- Taking on the Multi-Billion-Dollar Swipe Industry: AI Curates Who You Meet—IRL over brunch

- Safe Health Zones: A Global Breakthrough to Protect Night-Shift Workers from Preventable Harm

- Cartwheel Signs Letter of Intent to License Clearsight Therapeutics' Novel Pink Eye Treatment for 2027 Portfolio Expansion

- Vet Maps Launches National Platform to Spotlight Veteran-Owned Businesses and Causes

- $114.6 Million in Revenues, Up 54%: Uni-Fuels Holdings (N A S D A Q: UFG) Accelerates Global Expansion Across Major Shipping Hubs as Demand Surges

- Dental Care Solutions Unveils New Website for Enhanced Patient Engagement

- TradingHabits.com Launches to Support Day Trader Well-being

- $750 Million Market on Track to $3.35 Billion by 2034: $NRXP Launches First-in-Florida "One Day" Depression Treatment in Partnership with Ampa Health

- $750 Million Market Set to Soar to $3.35 Billion by 2034 as Florida Launches First-in-Nation One-Day: NRx Pharmaceuticals (N A S D A Q: NRXP) $NRXP

- BITE Data raises $3m to build AI tools for global trade compliance teams

- Phinge Issues Notice of Possible Infringement, Investigates App-less AI Agents & Technology for Unauthorized Use of its Patented App-less Technologies