Trending...

- Wohler announces three SRT monitoring enhancements for its iVAM2-MPEG monitor and the addition of front panel PID selection of A/V/subtitle streams

- Safe Health Zones: A Global Breakthrough to Protect Night-Shift Workers from Preventable Harm

- Torch Entertainment Presents The Frozen Zoo

$IQST is a Global Communications Leader Scaling with High-Tech, High-Margin Growth Strategy

CORAL GABLES, Fla. - PrAtlas -- IQSTEL, Inc. (N A S D A Q: IQST) is not just a telecom company anymore — it's emerging as a diversified technology powerhouse with bold ambitions and the roadmap to back them up.

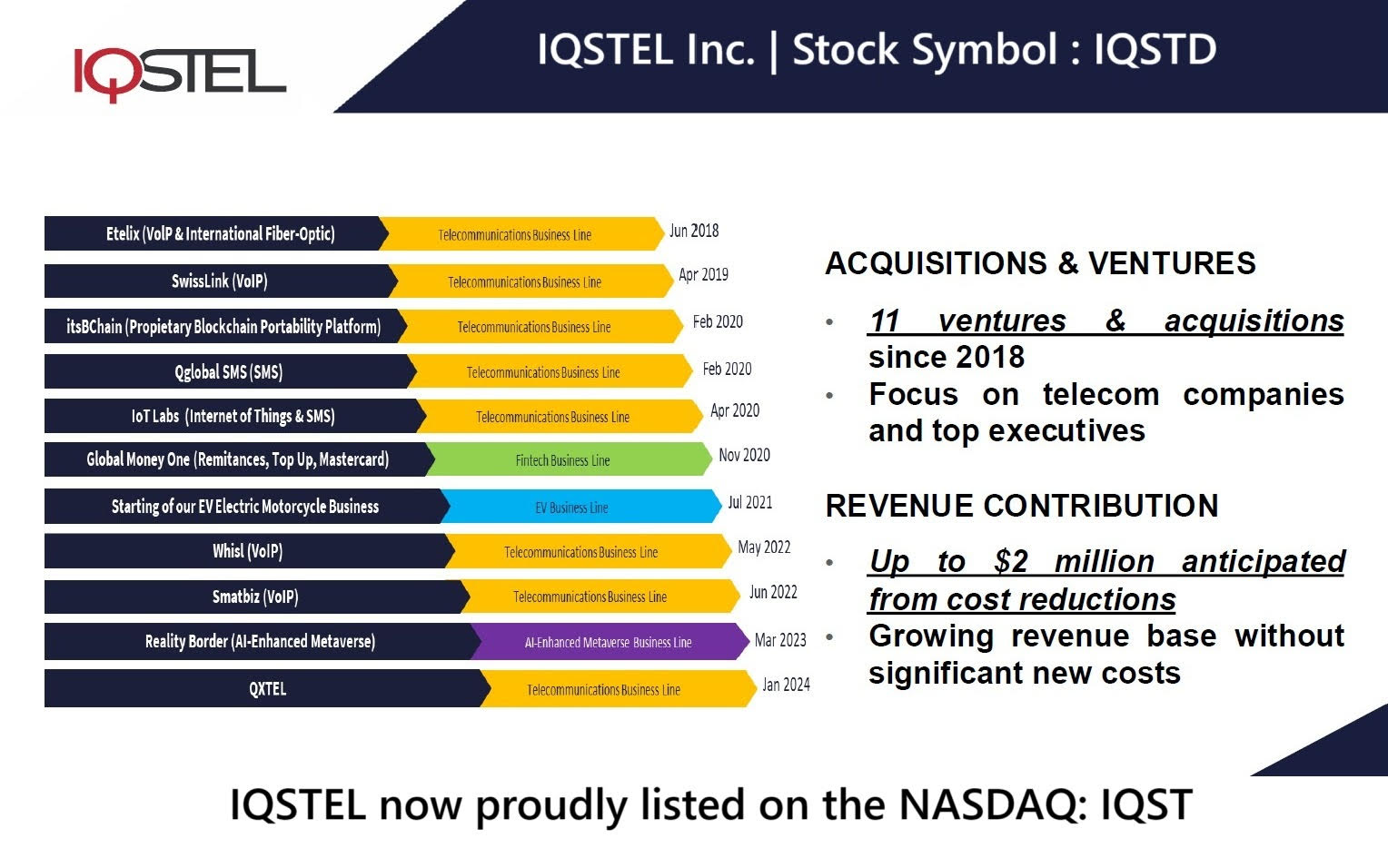

With an impressive $400M annual revenue run rate already achieved five months ahead of schedule, IQSTEL is setting the stage for a $15 million EBITDA run rate in 2026 and a $1 billion revenue milestone by 2027. This rapid growth trajectory, backed by cutting-edge innovations in Telecom, Fintech, Artificial Intelligence, Blockchain, Electric Vehicles, and Cybersecurity, positions IQSTEL as one of the most dynamic emerging tech stories on the N A S D A Q.

🔥 Why Investors Are Watching IQST Closely:

💸 $6.9 Million Debt Cut — Almost $2 Per Share in Value Unlocked

IQSTEL continues to strengthen its balance sheet, eliminating $6.9 million in debt — a move that directly enhances shareholder value and reinforces long-term growth. This cut translates to nearly $2 per share, delivering significant intrinsic value while improving financial flexibility.

📈 $35M in July Revenue – Rocketing Past $400M Run Rate

In July alone, IQSTEL reported $35 million in revenue, placing the company well on track to hit — and likely exceed — its FY-2025 revenue target of $340 million. The growth is organic and consistent, underscoring IQST's proven execution capabilities.

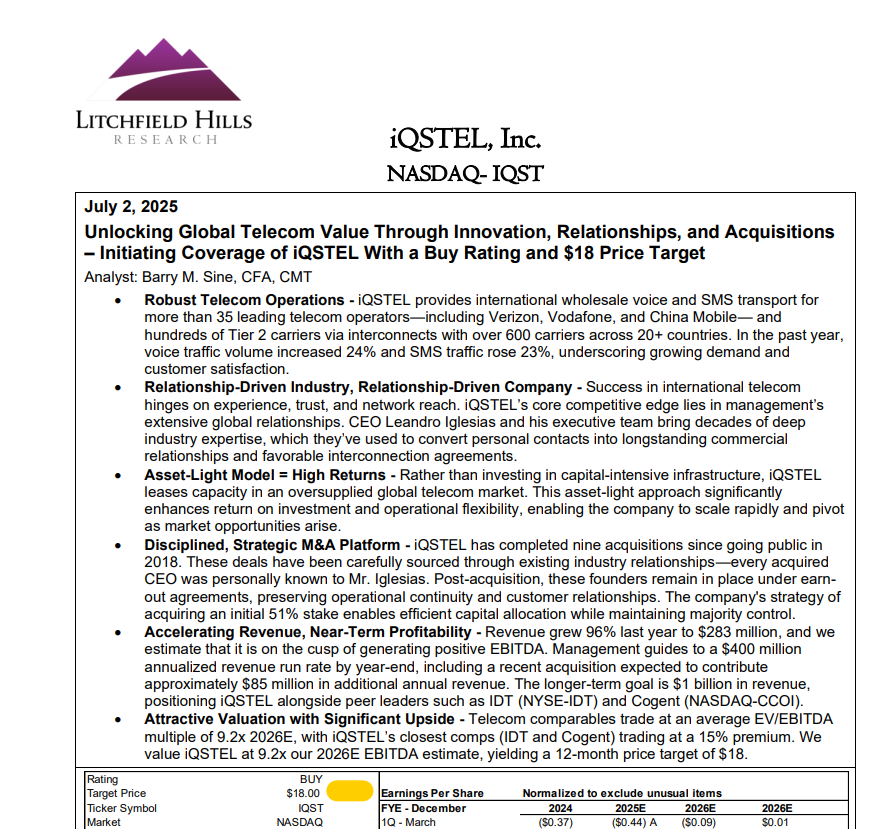

🔍 Litchfield Hills Research Reaffirms $18 Price Target

Following IQST's Q2 2025 results, Litchfield Hills Research reiterated its $18 price target, highlighting the company's rising EBITDA, strong equity position, and growing market influence. This implies a multi-fold upside from current levels, driven by strong fundamentals and strategic vision.

💡 Next-Generation AI Solutions: IQ2Call and Reality Border

IQSTEL is redefining the call center model with IQ2Call, a proprietary AI-powered platform created through its AI subsidiary Reality Border LLC. This transformative solution blends real-time AI automation with human intelligence, setting a new standard for efficiency and customer experience in the $750B global contact center industry.

More on PrAtlas

🚑 Healthcare Sector Focus: IQST has partnered with Mobility Tech, a top-tier call center firm specializing in U.S. healthcare. This collaboration brings next-gen AI directly to one of the most demanding sectors, driving high-margin enterprise adoption.

🧭 The Roadmap: From $400M Run Rate to $1 Billion Revenue

IQSTEL's aggressive growth plan is underpinned by a clear strategic path:

The company's two-pronged "pincer strategy" — strategic acquisitions and organic high-margin growth — is already in motion. IQST is targeting 2–3 acquisitions, each expected to contribute approximately $5 million in EBITDA, further accelerating growth and shareholder value.

🔄 Shareholder Value at the Core: Equity Exchange with CYCU

IQSTEL is enhancing shareholder value with a unique equity partnership with CYCU, involving a $1 million stock exchange. Notably, half of the exchanged shares will be distributed as a dividend — a shareholder-friendly move rarely seen in growth-stage tech firms.

📊 Q2 2025 Financial Highlights: Record Metrics Across the Board

🌍 Strategic Acquisitions: GlobeTopper Now Consolidated

IQST officially closed its 51% acquisition of GlobeTopper as of July 1, 2025. This fintech acquisition is forecasted to contribute:

GlobeTopper expands IQST's fintech footprint and brings a global customer base, new tech capabilities, and cross-selling synergies.

More on PrAtlas

🔒 Diversified, Global, and Built for the Future

Operating in 21 countries, IQSTEL has evolved into a truly global force, uniquely positioned to capitalize on converging trends in AI, Fintech, and Connectivity. From EV technology to cybersecurity solutions, IQSTEL's diversified portfolio delivers high-margin, high-impact services tailored for the next decade.

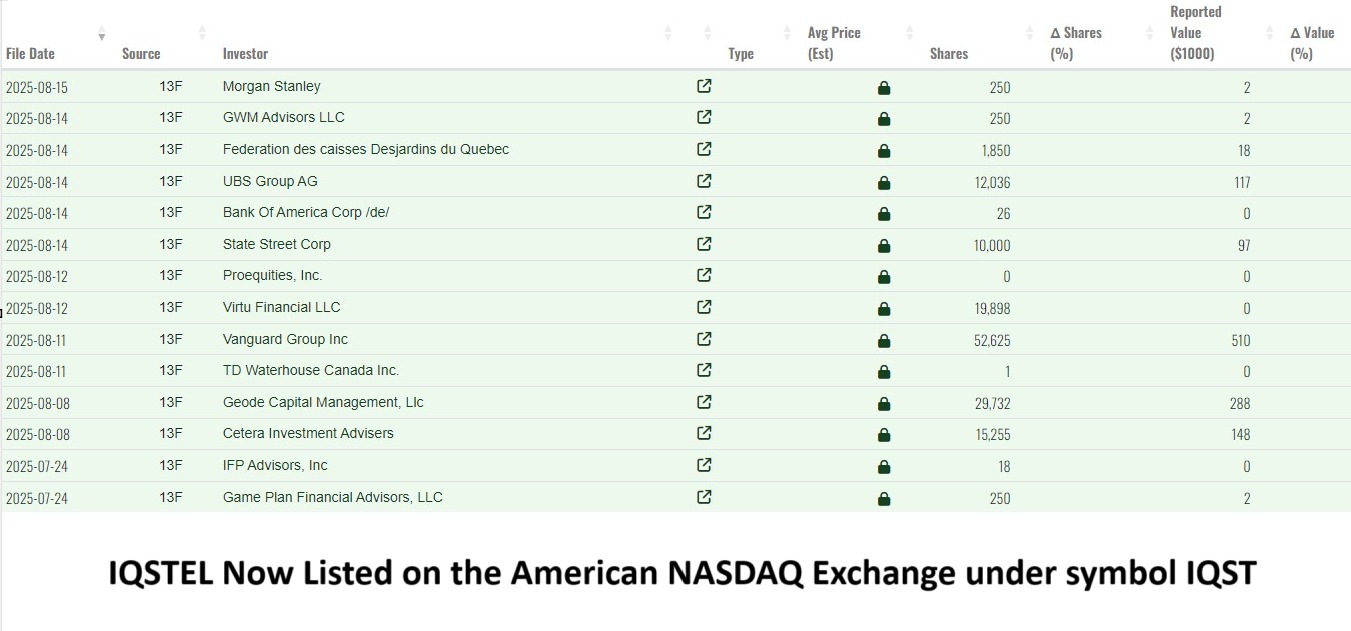

📣 Institutional Interest Rising

Since uplisting to Nasdaq just 120 days ago, approximately 12 institutional investors now hold 4% of IQST shares, signaling growing confidence in the company's vision and execution.

📊 Nasdaq Institutional Holdings: View here

✅ Bottom Line: IQSTEL Is a Billion-Dollar Story in the Making

IQSTEL (N A S D A Q: IQST) is firing on all cylinders — delivering consistent growth, eliminating debt, innovating with AI, and expanding through smart acquisitions. With a strong foundation, clear roadmap, and expanding market footprint, IQST offers investors a compelling opportunity to participate in a high-growth, tech-enabled global transformation.

📈 Price Target: $18 (Litchfield Hills Research)

🎯 Revenue Goal: $1 Billion by 2027

💼 2026 EBITDA Target: $15 Million

🌐 Visit: www.IQSTEL.com

Media Contact:

Leandro Jose Iglesias – President & CEO

📧 investors@iqstel.com

📞 +1 954-951-8191

🌍 www.IQSTEL.com

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With an impressive $400M annual revenue run rate already achieved five months ahead of schedule, IQSTEL is setting the stage for a $15 million EBITDA run rate in 2026 and a $1 billion revenue milestone by 2027. This rapid growth trajectory, backed by cutting-edge innovations in Telecom, Fintech, Artificial Intelligence, Blockchain, Electric Vehicles, and Cybersecurity, positions IQSTEL as one of the most dynamic emerging tech stories on the N A S D A Q.

🔥 Why Investors Are Watching IQST Closely:

💸 $6.9 Million Debt Cut — Almost $2 Per Share in Value Unlocked

IQSTEL continues to strengthen its balance sheet, eliminating $6.9 million in debt — a move that directly enhances shareholder value and reinforces long-term growth. This cut translates to nearly $2 per share, delivering significant intrinsic value while improving financial flexibility.

📈 $35M in July Revenue – Rocketing Past $400M Run Rate

In July alone, IQSTEL reported $35 million in revenue, placing the company well on track to hit — and likely exceed — its FY-2025 revenue target of $340 million. The growth is organic and consistent, underscoring IQST's proven execution capabilities.

🔍 Litchfield Hills Research Reaffirms $18 Price Target

Following IQST's Q2 2025 results, Litchfield Hills Research reiterated its $18 price target, highlighting the company's rising EBITDA, strong equity position, and growing market influence. This implies a multi-fold upside from current levels, driven by strong fundamentals and strategic vision.

💡 Next-Generation AI Solutions: IQ2Call and Reality Border

IQSTEL is redefining the call center model with IQ2Call, a proprietary AI-powered platform created through its AI subsidiary Reality Border LLC. This transformative solution blends real-time AI automation with human intelligence, setting a new standard for efficiency and customer experience in the $750B global contact center industry.

More on PrAtlas

- New Smile Now Introduces RAYFace 3D Scanner to Advance Digital Surgery

- Ali Alijanian, DDS Featured in The Profitable Dentist Magazine

- "Meet the Eatmons" Offer Financial Advice ahead of the Holidays

- CCHR: Study Finds Involuntary Commitment Fails to Prevent Suicide, Raises Risk

- Slotozilla's Q3 2025: SBC Lisbon Outcomes and Partnership Expansion

🚑 Healthcare Sector Focus: IQST has partnered with Mobility Tech, a top-tier call center firm specializing in U.S. healthcare. This collaboration brings next-gen AI directly to one of the most demanding sectors, driving high-margin enterprise adoption.

🧭 The Roadmap: From $400M Run Rate to $1 Billion Revenue

IQSTEL's aggressive growth plan is underpinned by a clear strategic path:

- 2025 – Build on the $400M revenue run rate, optimize for margins, and reduce debt.

- 2026 – Reach a $15M EBITDA run rate, triggering potential market capitalization of $150M–$300M based on standard EBITDA multiples.

- 2027 – Achieve $1B in revenue, positioning IQST among the top global tech leaders.

The company's two-pronged "pincer strategy" — strategic acquisitions and organic high-margin growth — is already in motion. IQST is targeting 2–3 acquisitions, each expected to contribute approximately $5 million in EBITDA, further accelerating growth and shareholder value.

🔄 Shareholder Value at the Core: Equity Exchange with CYCU

IQSTEL is enhancing shareholder value with a unique equity partnership with CYCU, involving a $1 million stock exchange. Notably, half of the exchanged shares will be distributed as a dividend — a shareholder-friendly move rarely seen in growth-stage tech firms.

📊 Q2 2025 Financial Highlights: Record Metrics Across the Board

- Net Shareholder Equity: Grew from $11.9M to $14.29M (pre-July debt reduction).

- Gross Revenue: $155.15M in H1 2025, 17% YoY growth, fully organic.

- Gross Margin: Improved 7.45% YoY.

- Telecom Net Income: +29.94% QoQ.

- Adjusted EBITDA: $1.1 million for H1 2025.

- Assets per Share: $17.41 | Equity per Share: $4.84 (pre-debt cut).

🌍 Strategic Acquisitions: GlobeTopper Now Consolidated

IQST officially closed its 51% acquisition of GlobeTopper as of July 1, 2025. This fintech acquisition is forecasted to contribute:

- $34 million in revenue

- $260K in EBITDA in H2 2025

- Starting at $5M in July, scaling to $6M+ by December

GlobeTopper expands IQST's fintech footprint and brings a global customer base, new tech capabilities, and cross-selling synergies.

More on PrAtlas

- Historic Announcement for the Global Car Rental Industry

- Siembra Brings 18 Latinx Artists Together in Brooklyn Exhibition

- Gramercy Tech Launches StoryStream

- Turbo vs. Experts: Tracking OddsTrader's AI Performance at the NFL's Midpoint

- Outreaching.io Appoints Rameez Ghayas Usmani as CEO, Recognized as Best HARO Link Building Expert in the United States

🔒 Diversified, Global, and Built for the Future

Operating in 21 countries, IQSTEL has evolved into a truly global force, uniquely positioned to capitalize on converging trends in AI, Fintech, and Connectivity. From EV technology to cybersecurity solutions, IQSTEL's diversified portfolio delivers high-margin, high-impact services tailored for the next decade.

📣 Institutional Interest Rising

Since uplisting to Nasdaq just 120 days ago, approximately 12 institutional investors now hold 4% of IQST shares, signaling growing confidence in the company's vision and execution.

📊 Nasdaq Institutional Holdings: View here

✅ Bottom Line: IQSTEL Is a Billion-Dollar Story in the Making

IQSTEL (N A S D A Q: IQST) is firing on all cylinders — delivering consistent growth, eliminating debt, innovating with AI, and expanding through smart acquisitions. With a strong foundation, clear roadmap, and expanding market footprint, IQST offers investors a compelling opportunity to participate in a high-growth, tech-enabled global transformation.

📈 Price Target: $18 (Litchfield Hills Research)

🎯 Revenue Goal: $1 Billion by 2027

💼 2026 EBITDA Target: $15 Million

🌐 Visit: www.IQSTEL.com

Media Contact:

Leandro Jose Iglesias – President & CEO

📧 investors@iqstel.com

📞 +1 954-951-8191

🌍 www.IQSTEL.com

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business, Technology, Telecom, Stocks, Financial, Finance, Artificial Intelligence, Stock Market, Press Release, Nasdaq, Cybersecurity, Fintech

0 Comments

Latest on PrAtlas

- Sweet Memories Vintage Tees Debuts Historic ORCA™ Beverage Nostalgic Soda Collection

- UK Financial Ltd Celebrates Global Recognition as MayaCat (MCAT) Evolves Into SMCAT — The World's First Meme Coin Under ERC-3643 Compliance

- U.S. Military to Benefit from Drone Tech Agreement with NovaSpark Energy, Plus Longer NASA Space Missions via Solar Power Leader: Ascent Solar $ASTI

- $76 Million in Gold & Silver Holdings and Expanding Production — Pioneering the Future of Gold: Asia Broadband Inc. (Stock Symbol: AABB) is Surging

- Wohler announces three SRT monitoring enhancements for its iVAM2-MPEG monitor and the addition of front panel PID selection of A/V/subtitle streams

- Schemawriter.ai launches WordPress plugin as industry leaders confirm - schema markup is critical

- 20 Million Financing to Accelerate Growth and Advance Digital Asset Strategy Secured for Super League (N A S D A Q: SLE)

- uCAR Trading Launches goldsilbermarkt.de, a New Online Shop for Precious Metals

- Webinar Announcement: Reputational Risk Management in Internal Investigations: Controlling the Narrative Before, During, and After a Crisis

- Taking on the Multi-Billion-Dollar Swipe Industry: AI Curates Who You Meet—IRL over brunch

- Safe Health Zones: A Global Breakthrough to Protect Night-Shift Workers from Preventable Harm

- Cartwheel Signs Letter of Intent to License Clearsight Therapeutics' Novel Pink Eye Treatment for 2027 Portfolio Expansion

- Vet Maps Launches National Platform to Spotlight Veteran-Owned Businesses and Causes

- $114.6 Million in Revenues, Up 54%: Uni-Fuels Holdings (N A S D A Q: UFG) Accelerates Global Expansion Across Major Shipping Hubs as Demand Surges

- Dental Care Solutions Unveils New Website for Enhanced Patient Engagement

- TradingHabits.com Launches to Support Day Trader Well-being

- $750 Million Market on Track to $3.35 Billion by 2034: $NRXP Launches First-in-Florida "One Day" Depression Treatment in Partnership with Ampa Health

- $750 Million Market Set to Soar to $3.35 Billion by 2034 as Florida Launches First-in-Nation One-Day: NRx Pharmaceuticals (N A S D A Q: NRXP) $NRXP

- BITE Data raises $3m to build AI tools for global trade compliance teams

- Phinge Issues Notice of Possible Infringement, Investigates App-less AI Agents & Technology for Unauthorized Use of its Patented App-less Technologies