Trending...

- Crowdfunding Campaign Tips Off for 'NAWFSIDE' Short Film Highlighting Pressure in Youth Sports

- Fleet Mining Cloud Mining Platform — Latest Guide: Making Bitcoin Mining Safer and More Convenient

- Keebos Launches Crossbody Cases for Every iPhone 17 Model

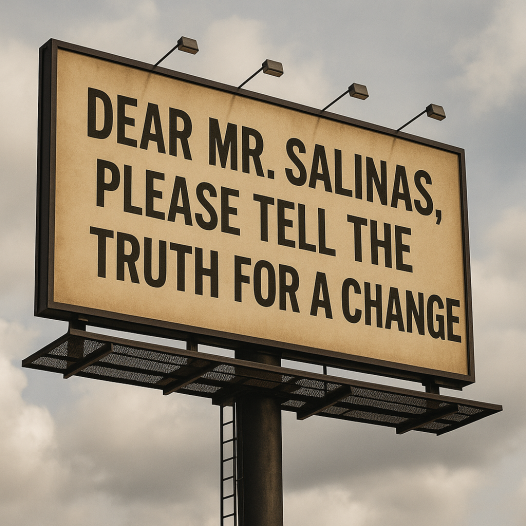

Fiction versus reality. The world must know the truth. Will Ricardo Salinas ever tell the truth?

LONDON - PrAtlas -- NEW YORK — In recent weeks, Ricardo Salinas Pliego has made a series of public claims about his July 28, 2021 loan agreement with Astor Asset Management 3 Ltd ("Astor 3").

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on PrAtlas

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on PrAtlas

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on PrAtlas

- "The Art of Philanthropy" — A Year-Long Campaign Supporting the USO and Military Veterans

- TRUE Palliative Care Launches as California Strengthens Commitment to Compassionate Care Under SB 403

- Mysterious Interstellar Object 3I/ATLAS Appears to Pause Near Mars, Exhibiting Periodic Light Pulses

- $73.6 Million in Order Backlog Poised for Explosive Growth in 2026; Streamlined Share Structure: Cycurion, Inc. (N A S D A Q: CYCU) $CYCU

- Osric Langevin Unveils "Quantitative Trend" Framework for Multi-Asset Analysis in Q4 2025

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on PrAtlas

- Experience Days Named Among the UK's Top Christmas Gifts

- New Free Educational Bingo Cards Make Learning English Fun for First Graders

- Wzzph Provides Stablecoin Trading Solutions for Latin American Traders Amid Digital Currency Policy Adjustments

- NaturismRE Calls for Recognition of AI as Sentient Kin in Global Bill of Rights

- PDS Plumbing & Air Honors Veterans with "Free Tune-Up & A Turkey" Giveaway

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Source: Astor Asset Management 3 Ltd

0 Comments

Latest on PrAtlas

- Crowdfunding Campaign Tips Off for 'NAWFSIDE' Short Film Highlighting Pressure in Youth Sports

- Icarus IFE Systems Launches the Icarus One Portable Inflight Entertainment System — The World's Most Advanced Offline AI-Driven IFE Platform

- AEI Stands Firmly with Pakistani Aircraft Engineers facing retaliation for reporting safety concerns

- Literary fiction novel- 'Skylark' wins Bronze Medal

- Kaltra unveils reversible microchannel coils – engineered for modern heat pumps

- Phinge Announces Proposal to Combat Billions in Government Waste, Fraud, and Abuse with Proactive, Hardware-Verified Netverse App-Less Platform

- Taboo: The Lost Codes of Men — A Bold New Book Confronting the Crisis of Modern Manhood

- Phinge's Netverse to Redefine Clinical Trial Safety and Data Integrity with Netverse Patented, Hardware-Verified Platform

- 'Wild Hermit Wellness' Has Achieved Bestseller Status in Just 2 Months Since Launch Of Organic Skincare Line

- Easton & Easton, LLP Sues The Dwelling Place Anaheim and Vineyard USA for Failing to Protect Minor from Church Leaders' Sexual Abuse

- Lokal Media House Earns ServiceTitan Certified Marketer Status

- Wall Street's New Obsession? Tradewinds Aims to Revolutionize the $8B Gentlemen's Club Industry with National Peppermint Hippo™ Strategy $TRWD

- Poised for Major Growth with Strategic Military Orders, Global Expansion, and Groundbreaking Underground Mining Initiative $RMXI

- XRP fever is coming again, WOA Crypto helps the new trend and earns tens of thousands of dollars a day

- Inflation Rebounds Under Tariff Shadow: Wall Street Veteran Kieran Winterbourne Says Macro Signals Matter More Than Market Sentiment

- Mensa Foundation's New Science Program Encourages Hands-On Discovery

- Golden Paper Introduces TAD Hand Towel Technology, Ushering in a New Era of Premium Tissue Quality

- ReedSmith® Creates Founder-Investor Connections at The Investor Dating Game™ by Tech Coast Venture Network During LA Tech Week

- OfficeSpaces.co Expands Its AI-Powered Website Builder Across North America

- Tobu Railway Group Will Host the Fourth Annual "Take-Akari" Bamboo Lantern Festival in East Tokyo, November 7, 2025 – January 31, 2026